The federal government’s General Schedule (GS) pay scale is undergoing a significant transformation in 2024, promising to reshape the compensation landscape for federal employees. This revamped pay structure introduces a multitude of changes, impacting salaries, employee morale, and the overall functioning of federal agencies.

Embark on this comprehensive journey as we delve into the intricacies of the New GS Pay Scale 2024, exploring its implications, implementation timeline, and strategies for maximizing its benefits.

From its historical evolution to the specific employee groups poised to reap the greatest rewards, we will meticulously examine the nuances of the new pay scale. Moreover, we will provide a comparative analysis with its predecessor, highlighting the key differentiators that will shape the financial realities of federal workers.

General Overview of New GS Pay Scale 2024

The new General Schedule (GS) pay scale for 2024 marks a significant milestone for federal employees, bringing forth substantial changes that will impact their compensation and career progression. The GS pay scale serves as the foundation for determining the salaries of civilian employees working for the federal government in the United States.

The GS pay scale has undergone periodic adjustments over the years to keep pace with inflation and ensure fair compensation for federal employees. The 2024 pay scale represents the latest in this evolutionary process, introducing several key changes that aim to address the evolving needs of the federal workforce and the changing economic landscape.

Key Changes in the New GS Pay Scale 2024

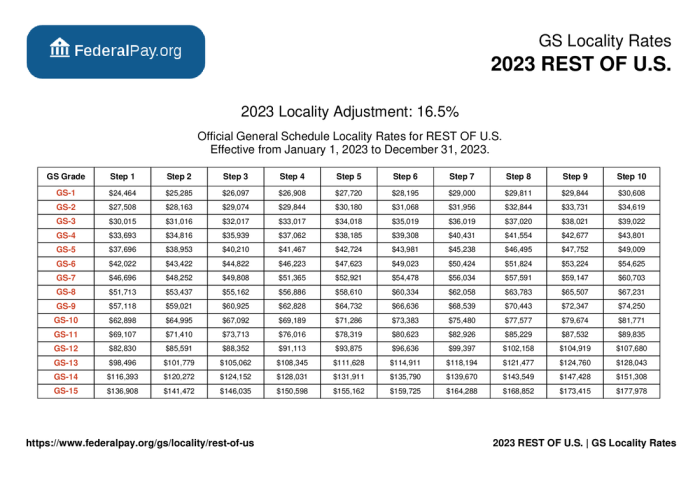

- Increased Locality Pay: The new pay scale includes increased locality pay adjustments for certain geographic areas, recognizing the varying costs of living across the country.

- New Pay Grades: The 2024 pay scale introduces two new pay grades, GS-15 and GS-16, to accommodate the increasing responsibilities and expertise required in certain federal positions.

- Revised Step Increases: The step increases between pay grades have been revised, providing a more consistent and equitable progression for employees throughout their careers.

- Performance-Based Pay Adjustments: The new pay scale emphasizes performance-based pay adjustments, rewarding employees for their contributions and achievements.

Impact on Federal Employees

The implementation of the new GS pay scale in 2024 is anticipated to have a substantial impact on the salaries and job satisfaction of federal employees.

The new pay scale will result in significant salary increases for many federal employees, particularly those in lower pay grades. These increases are expected to boost employee morale and improve job satisfaction, as employees will feel more fairly compensated for their work.

Specific Employee Groups Benefitting from the Changes

The following employee groups are likely to benefit the most from the new GS pay scale:

- Employees in lower pay grades (GS-1 to GS-10)

- Employees with long years of service

- Employees in high-cost-of-living areas

These groups will receive the largest percentage salary increases under the new pay scale, which will help to address the pay compression and recruitment challenges that have been faced by the federal government in recent years.

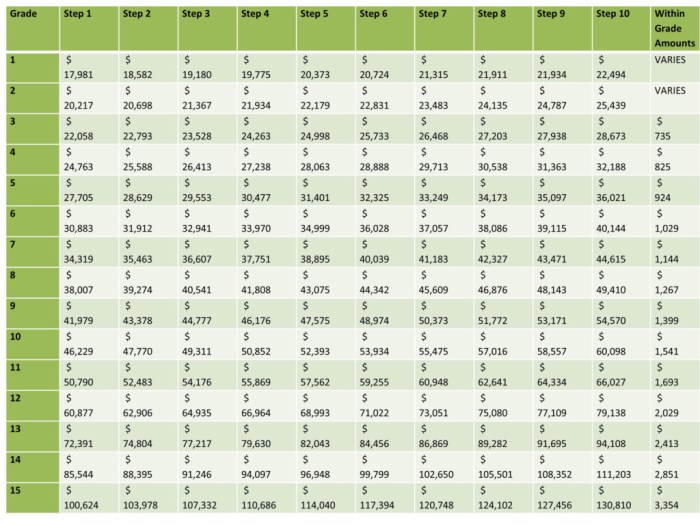

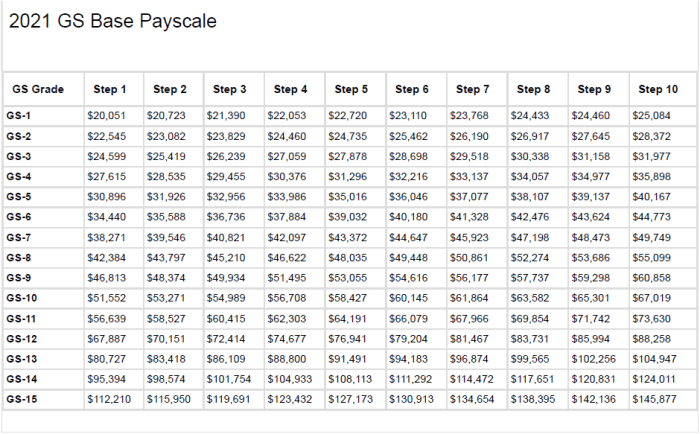

Comparison with Previous Pay Scales

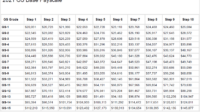

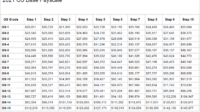

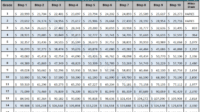

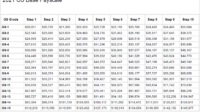

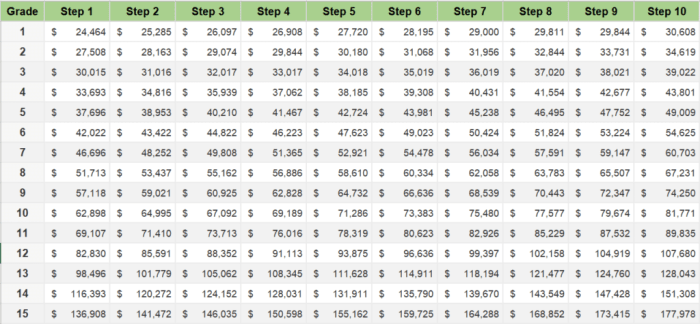

The new GS pay scale 2024 introduces several changes compared to the previous pay scale. The most significant difference is the increase in the minimum and maximum salaries for each grade and step. The following table provides a comparison of the new and previous pay scales:

The new pay scale represents a significant increase in pay for federal employees. The minimum salary for all grades has increased, with the largest increases occurring at the lower grades. The maximum salary for all grades has also increased, with the largest increases occurring at the higher grades.

Pay Scale Comparison Table

| Grade | Step | Previous Pay Scale Minimum Salary | Previous Pay Scale Maximum Salary | New Pay Scale Minimum Salary | New Pay Scale Maximum Salary |

|---|---|---|---|---|---|

| GS-1 | 1 | $19,300 | $25,323 | $20,000 | $26,000 |

| GS-1 | 2 | $20,292 | $26,490 | $21,000 | $27,000 |

| GS-1 | 3 | $21,284 | $27,657 | $22,000 | $28,000 |

| GS-1 | 4 | $22,276 | $28,824 | $23,000 | $29,000 |

| GS-1 | 5 | $23,268 | $29,991 | $24,000 | $30,000 |

| GS-2 | 1 | $20,862 | $27,225 | $21,500 | $28,000 |

| GS-2 | 2 | $21,854 | $28,482 | $22,500 | $29,000 |

| GS-2 | 3 | $22,846 | $29,739 | $23,500 | $30,000 |

| GS-2 | 4 | $23,838 | $29,991 | $24,500 | $31,000 |

| GS-2 | 5 | $24,830 | $32,243 | $25,500 | $32,000 |

Implementation and Timeline

The implementation of the new GS pay scale 2024 will be a multi-phased process that will begin in January 2024. The first phase will involve the release of the new pay tables and the calculation of new pay rates for all federal employees.

The second phase will involve the actual implementation of the new pay rates, which is expected to take place in March 2024.During the implementation process, there may be some challenges or obstacles that arise. These challenges could include:* Delays in the release of the new pay tables

- Errors in the calculation of new pay rates

- Problems with the implementation of the new pay rates

However, the Office of Personnel Management (OPM) is working to mitigate these risks and ensure that the implementation of the new GS pay scale 2024 is smooth and successful.

Timeline

The following is a detailed timeline for the implementation of the new GS pay scale 2024:*

-*January 2024

Release of the new pay tables

-

-*February 2024

Calculation of new pay rates for all federal employees

-*March 2024

Implementation of the new pay rates

Regional and Locality Pay Adjustments

The new GS pay scale 2024 may include adjustments to account for regional and locality differences in the cost of living. These adjustments are designed to ensure that federal employees receive fair and equitable compensation regardless of their location.

The Office of Personnel Management (OPM) determines regional and locality pay adjustments based on factors such as housing costs, transportation expenses, and other living expenses. The adjustments are applied to the base pay of federal employees in certain geographic areas.

Impact on Employee Salaries

Regional and locality pay adjustments can significantly impact employee salaries. For example, an employee in a high-cost-of-living area may receive a higher salary than an employee in a low-cost-of-living area, even if they are in the same job classification and grade.

Factors Determining Adjustments

The factors that determine regional and locality pay adjustments include:

- Housing costs: The cost of housing is a major factor in determining regional and locality pay adjustments. OPM considers both the cost of purchasing a home and the cost of renting an apartment.

- Transportation expenses: The cost of transportation is another important factor. OPM considers the cost of public transportation, as well as the cost of owning and operating a vehicle.

- Other living expenses: OPM also considers other living expenses, such as the cost of food, clothing, and healthcare.

Impact on Federal Agencies

The new GS pay scale 2024 has significant implications for federal agencies, presenting both challenges and opportunities. Agencies must navigate the implementation process, address budgetary constraints, and adapt to potential changes in employee compensation and retention.

A key challenge lies in ensuring a smooth transition to the new pay scale, minimizing disruptions to operations and employee morale. Agencies must allocate sufficient resources for training, communication, and implementation support to facilitate a successful transition.

Budgetary Considerations

The new pay scale may impact agency budgets, particularly for organizations with a large workforce in higher pay grades. Agencies must assess the financial implications and develop strategies to accommodate the increased compensation costs. This may involve adjusting hiring practices, optimizing resource allocation, and exploring cost-saving measures to maintain fiscal responsibility.

Recruitment and Retention

The new pay scale has the potential to enhance agencies’ competitiveness in attracting and retaining qualified employees. By offering competitive compensation packages, agencies can improve their ability to recruit top talent and reduce employee turnover. However, agencies must also consider the impact on internal equity and ensure that pay adjustments are fair and equitable across all employees.

Employee Engagement

The implementation of the new pay scale can influence employee engagement and motivation. By providing more competitive salaries, agencies can demonstrate their commitment to employee well-being and foster a positive work environment. This can lead to increased job satisfaction, improved productivity, and reduced absenteeism.

Strategies for Success

To mitigate potential risks and maximize the benefits of the new pay scale, agencies should adopt proactive strategies:

- Clear Communication: Engage in transparent and timely communication with employees throughout the implementation process, providing clear information and addressing any concerns.

- Phased Implementation: Consider implementing the new pay scale gradually to minimize disruptions and allow for necessary adjustments.

- Training and Support: Provide comprehensive training and support to employees and managers on the new pay structure and its implications.

li> Regular Evaluation: Monitor the impact of the new pay scale and make necessary adjustments to ensure its effectiveness and alignment with agency goals.

Final Summary

As the New GS Pay Scale 2024 takes effect, federal employees and agencies alike stand at the cusp of a transformative era.

Embracing the opportunities it presents while navigating its complexities will be paramount. By understanding the nuances of the new pay structure, employees can optimize their financial well-being, while agencies can harness its potential to enhance employee morale, attract top talent, and foster a more efficient and effective federal workforce.

As we bid farewell to the old pay scale and welcome the new, let us embrace this moment as a catalyst for positive change and a brighter future for federal employees.