GS Pay and Cost of Living: Locality Adjustments Explained – Yeah, so you’re probably wondering, “How does my pay change depending on where I live?” Well, it’s all about locality adjustments. This whole system is like figuring out how much extra you need to make to live comfortably in different parts of the country.

It’s not just about the cost of rent, but also things like groceries, gas, and even going out to eat. So, let’s break it down and see how it all works.

The government uses a system called “locality pay” to make sure federal employees can afford to live in different areas. It’s basically a cost-of-living adjustment, making sure your paycheck keeps up with the local prices. It’s a complex system with a lot of factors, but it’s important to understand how it works, especially if you’re thinking about working for the government or moving to a new city.

Introduction to GS Pay and Locality Adjustments

The General Schedule (GS) pay system is the foundation of compensation for federal employees in the United States. It establishes a standardized pay scale based on grade levels and steps within each grade, reflecting the complexity and responsibility of the position.

GS pay is a crucial component of federal employment, ensuring fair and equitable compensation for employees across various agencies and locations. However, the cost of living varies significantly across the country, influencing the affordability of housing, transportation, and other necessities.

Understanding the nuances of the GS pay scale is crucial for administrative assistants, as it dictates their potential earnings and how they are impacted by cost of living adjustments. These adjustments, known as locality pay, are designed to reflect regional variations in the cost of living.

To navigate the complexities of the GS pay scale and understand how locality pay affects your earnings, consult Navigating the GS Pay Scale 2024: A Comprehensive Guide for Administrative Assistants. This resource provides valuable insights into the pay scale and how it is adjusted based on location.

By understanding these factors, administrative assistants can make informed decisions about their career paths and financial planning.

To address this disparity, the federal government implements locality adjustments, which are percentage increases applied to the base GS pay to account for regional cost of living differences.

Locality Adjustments: Bridging the Cost of Living Gap

Locality adjustments are essential in ensuring that federal employees receive competitive salaries that reflect the cost of living in their specific work locations. They help maintain the attractiveness of federal employment by ensuring that employees are adequately compensated for the cost of living in their assigned areas.

These adjustments play a vital role in attracting and retaining qualified talent in diverse regions across the country.

History and Evolution of Locality Adjustments

Locality adjustments have a long history, evolving alongside the recognition of regional cost of living disparities.

Understanding the nuances of GS pay and cost of living adjustments is crucial for federal employees, particularly those in IT fields. Navigating the GS Pay Scale 2024 can be daunting, but a comprehensive guide for IT professionals, Navigating the GS Pay Scale 2024: A Comprehensive Guide for IT Professionals , can help clarify salary expectations and locality adjustments.

By grasping the complexities of the GS pay scale, IT professionals can better understand their earning potential and navigate the challenges of finding a competitive salary in a specific location.

- Early Years:The concept of locality adjustments emerged in the 1970s as a response to growing concerns about the impact of regional cost of living differences on federal employee compensation. Early adjustments were often based on broad geographic areas, with limited precision in reflecting specific cost of living variations.

- Refinement and Expansion:Over time, the system has undergone significant refinement and expansion, incorporating more detailed cost of living data and incorporating a wider range of factors. The development of the Consumer Price Index (CPI) and other cost of living measures has provided more accurate data for calculating adjustments.

- Contemporary System:Today, the locality adjustment system is highly complex, utilizing a sophisticated methodology that considers various factors, including housing costs, transportation expenses, and consumer goods prices. The system is regularly reviewed and adjusted to ensure its accuracy and effectiveness in reflecting regional cost of living variations.

Factors Influencing Locality Adjustments

Locality pay adjustments are designed to ensure that federal employees are compensated fairly, taking into account the varying costs of living across the country. These adjustments are based on a complex formula that considers several key factors, ensuring that federal employees are paid competitively in relation to their private sector counterparts in the same geographic area.

Cost of Living Considerations

The cost of living is a major factor influencing locality pay rates. This includes the expenses associated with basic necessities like housing, transportation, food, and healthcare. The Office of Personnel Management (OPM) utilizes various data sources to assess the cost of living in different areas.

- Housing Costs:This factor encompasses the cost of renting or purchasing a home in a specific location. It takes into account factors such as average rent, mortgage rates, and property taxes.

- Transportation Expenses:This includes the cost of commuting to work, including gasoline, public transportation fares, and vehicle maintenance. OPM considers factors like average commute times and public transportation availability.

- Consumer Goods and Services:This category includes the cost of everyday items and services, such as groceries, utilities, clothing, and entertainment. OPM uses data from the Bureau of Labor Statistics (BLS) to assess these costs.

Methodology for Calculating Locality Adjustments

OPM employs a multi-step process to calculate locality adjustments. The process involves:

- Data Collection:OPM gathers data from various sources, including the BLS, to determine the cost of living in different geographic areas.

- Statistical Analysis:OPM analyzes the collected data using statistical models to identify the relative cost of living in different areas.

- Locality Pay Rate Calculation:Based on the statistical analysis, OPM determines the locality pay rate for each geographic area. This rate is expressed as a percentage of the base pay rate for federal employees.

- Annual Review and Adjustment:OPM reviews the locality pay rates annually to ensure they accurately reflect current cost of living conditions. Adjustments are made as necessary to reflect changes in the cost of living.

The formula used to calculate locality adjustments is complex and involves numerous variables. The OPM website provides detailed information on the methodology used to calculate locality pay rates.

Impact of Locality Adjustments on Federal Employees: GS Pay And Cost Of Living: Locality Adjustments Explained

Locality adjustments play a crucial role in shaping the overall compensation of federal employees. They directly influence the salaries of federal workers across different regions, aiming to ensure fair and competitive pay based on the cost of living in specific areas.

Benefits and Challenges of Locality Adjustments

Locality adjustments offer potential benefits and challenges for federal employees in various regions.

- Benefits:

- Competitive Salaries:Locality adjustments help federal employees in high-cost areas receive salaries comparable to those in the private sector, making federal jobs more attractive and retaining qualified talent. For instance, a federal employee working in New York City might receive a significantly higher salary than their counterpart in a less expensive location, ensuring their pay reflects the higher cost of living in the metropolitan area.

- Improved Recruitment and Retention:By offering competitive salaries, locality adjustments can make federal jobs more appealing to potential candidates, particularly in areas with a high cost of living. This can lead to better recruitment and retention of skilled employees, ultimately benefiting the federal workforce.

- Enhanced Employee Morale:When employees feel their salaries are fair and reflect the cost of living in their area, it can boost their morale and job satisfaction. This can lead to increased productivity and commitment to their work.

- Challenges:

- Potential Disparities:Locality adjustments can create salary disparities between federal employees in different regions, even for those with similar experience and qualifications. This can lead to concerns about fairness and equity among employees.

- Impact on Budget:Adjusting salaries based on location can have a significant impact on the federal budget. Maintaining competitive salaries in high-cost areas can lead to increased spending, potentially impacting other government programs.

- Difficulty in Determining Cost of Living:Accurately determining the cost of living in various locations can be challenging. The complexities of housing costs, transportation, and other factors can make it difficult to create a fair and accurate locality adjustment system.

Impact on Recruitment and Retention

Locality adjustments have a significant impact on the recruitment and retention of federal employees, particularly in high-cost areas. By offering salaries that are competitive with the private sector, locality adjustments make federal jobs more attractive to potential candidates. This is especially important in areas where the cost of living is high and competition for talent is fierce.

“Locality adjustments are essential for attracting and retaining a qualified workforce in high-cost areas. Without them, federal agencies would struggle to compete with private sector salaries and would likely lose talented employees.”

For example, federal agencies in major cities like San Francisco and New York City have reported increased recruitment and retention rates since the implementation of locality adjustments. These adjustments have helped agencies attract and retain highly skilled professionals who might otherwise have sought employment in the private sector.However, it’s important to note that locality adjustments are not a guaranteed solution for recruitment and retention challenges.

Other factors, such as career development opportunities, work-life balance, and agency culture, also play a crucial role in attracting and retaining employees.

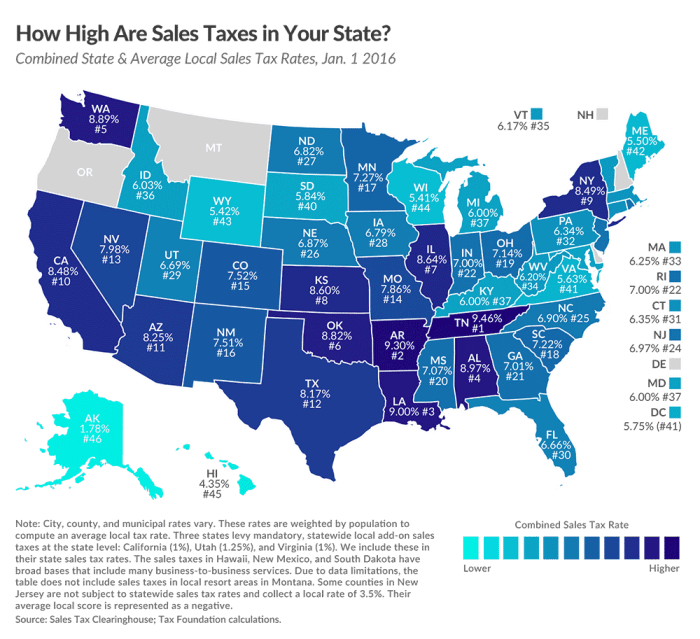

Locality Pay Rates Across the United States

Locality pay rates are adjusted based on the cost of living in different parts of the country. The Office of Personnel Management (OPM) conducts surveys and analyses to determine the cost of living in various metropolitan areas. The locality pay rates are then applied to federal employees’ salaries, reflecting the variations in living expenses.

Locality Pay Rates in Major Metropolitan Areas

The following table displays the current locality pay rates for selected major metropolitan areas:

| City | State | Locality Pay Percentage |

|---|---|---|

| New York City | NY | 32.7% |

| San Francisco | CA | 30.4% |

| Los Angeles | CA | 29.7% |

| Washington, D.C. | DC | 29.5% |

| Boston | MA | 28.3% |

| Chicago | IL | 25.6% |

| Seattle | WA | 24.7% |

| Atlanta | GA | 20.1% |

| Houston | TX | 19.4% |

| Philadelphia | PA | 18.6% |

Comparison of Locality Pay Rates in Different Regions

The locality pay rates vary significantly across different regions of the United States. Generally, metropolitan areas with higher costs of living, such as those in the Northeast and West Coast, tend to have higher locality pay rates. Conversely, areas with lower costs of living, such as those in the South and Midwest, typically have lower locality pay rates.

Factors Contributing to Variations in Locality Pay Rates

Several factors contribute to the variations in locality pay rates across geographic areas. These factors include:

- Cost of Housing:Housing costs are a significant factor in determining locality pay rates. Areas with high housing costs, such as major cities on the coasts, tend to have higher locality pay rates to compensate for the increased expenses.

- Cost of Transportation:The cost of transportation, including gas, public transportation, and vehicle ownership, also plays a role in locality pay adjustments. Areas with high transportation costs may have higher locality pay rates to help employees cover these expenses.

- Cost of Food:The cost of food, including groceries and dining out, is another factor considered in locality pay calculations. Areas with higher food costs may have higher locality pay rates to ensure that employees can afford to maintain a decent standard of living.

- Cost of Utilities:The cost of utilities, such as electricity, gas, and water, can also vary significantly across different regions. Areas with high utility costs may have higher locality pay rates to compensate for these expenses.

- Cost of Healthcare:The cost of healthcare, including medical insurance premiums and out-of-pocket expenses, is an important factor in locality pay calculations. Areas with high healthcare costs may have higher locality pay rates to help employees cover these expenses.

Future Trends in Locality Adjustments

The locality pay system, while designed to address regional cost of living differences, is constantly evolving to reflect changes in the economy, labor market, and the federal workforce itself. This section explores potential future trends in locality adjustments, including potential changes to the methodology used to calculate locality pay rates, the expansion or reduction of locality pay areas, and the consideration of other factors in determining locality adjustments.

Potential Changes to the Methodology for Calculating Locality Pay Rates

The methodology for calculating locality pay rates is a complex process involving various factors, including the Consumer Price Index (CPI), the cost of housing, and the average wage in different regions. The current methodology is based on data collected from the Bureau of Labor Statistics (BLS) and other sources.

Future changes to the methodology could involve:

- Using a more granular approach to data collection and analysis, potentially incorporating data from more specific regions or sectors.

- Introducing new factors into the calculation, such as the cost of transportation, healthcare, or childcare.

- Re-evaluating the weighting of existing factors to better reflect current economic realities.

Expansion or Reduction of Locality Pay Areas, GS Pay and Cost of Living: Locality Adjustments Explained

Locality pay areas are geographic regions where federal employees receive a locality adjustment. The boundaries of these areas are periodically reviewed and adjusted based on changes in the cost of living and other factors. Future trends in locality pay areas could involve:

- Expanding locality pay areas to encompass regions that are experiencing rapid economic growth or significant cost-of-living increases.

- Reducing locality pay areas in regions where the cost of living is decreasing or where there is less need to compensate for regional cost differences.

- Creating new locality pay areas to address emerging economic and demographic trends.

Consideration of Other Factors in Determining Locality Adjustments

In addition to the traditional factors used to determine locality adjustments, future trends could involve the consideration of other factors, such as:

- The availability and cost of housing in specific areas.

- The demand for skilled labor in different regions.

- The overall quality of life in different locations, including factors like education, healthcare, and safety.

End of Discussion

So, there you have it, the whole deal with GS Pay and locality adjustments. It’s not exactly a walk in the park to figure out, but hopefully, you’ve got a better understanding of how it works. It’s important to remember that these adjustments can make a big difference in your overall pay, especially if you’re moving to a high-cost area.

So, before you accept a job offer, make sure you know what your locality pay will be. It might just be the deciding factor in your decision.