GS Pay and Health Benefits: What You Need to Know – Navigating the world of GS Pay and Health Benefits can feel like deciphering an ancient scroll. But fear not, for we’re here to illuminate the path, guiding you through the intricacies of this vital system. Whether you’re a seasoned GS employee or just starting your journey, this guide is your compass to understanding the benefits you deserve.

Imagine a tapestry woven with threads of financial security and well-being. GS Pay and Health Benefits are the very foundation of this tapestry, offering a safety net for your financial future and a shield for your health. We’ll delve into the components of GS Pay, exploring its intricacies and unraveling the secrets of its structure.

Then, we’ll journey into the world of health benefits, uncovering the diverse plans and resources available to safeguard your well-being.

Introduction to GS Pay and Health Benefits: GS Pay And Health Benefits: What You Need To Know

GS Pay is the system used to calculate your salary and benefits as a civil servant. It’s a bit like a massive spreadsheet that figures out how much you get paid, based on your position, experience, and location. It’s super important because it’s how you get paid and how you access all the perks that come with working for the government.

One of the main perks is the health benefits offered by GS. These are like a safety net that helps you stay healthy and financially secure. They cover a bunch of different things, from doctor’s visits to prescriptions, and they can save you a lot of money in the long run.

This information is for everyone who works for the government, whether you’re just starting out or you’ve been working for ages. It’s especially useful if you’re new to the system or if you’re thinking about making a change to your benefits.

GS Pay Structure

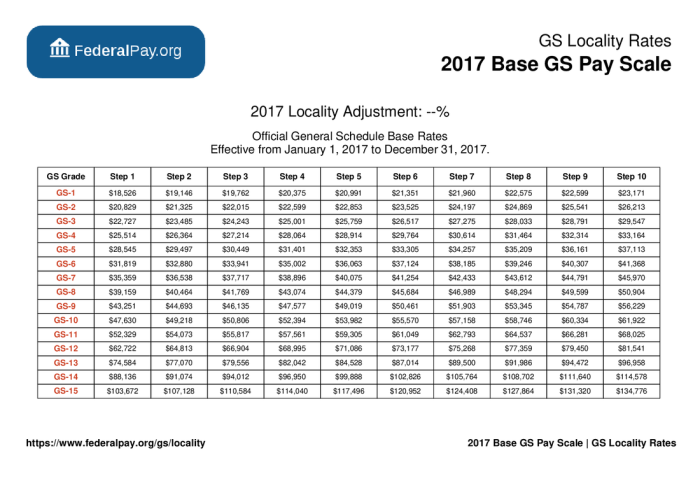

GS Pay is based on a system of grades, steps, and locality pay.

- Grades: These range from GS-1 to GS-15, and they represent your level of responsibility and experience.

- Steps: Within each grade, there are 10 steps, which reflect your time in service and performance.

- Locality Pay: This is an extra amount added to your base salary depending on where you work. Areas with a higher cost of living have a higher locality pay.

The higher your grade and step, the more you get paid.

Health Benefits Offered by GS

The government offers a wide range of health benefits to its employees, which can be confusing at first.

- Federal Employees Health Benefits Program (FEHB):This is the main health insurance program for federal employees. It offers a wide range of plans from different insurance companies, so you can choose the one that best fits your needs and budget.

- Federal Employees Dental and Vision Insurance Program (FEDVIP):This program offers dental and vision insurance plans to federal employees.

- Long Term Care Insurance (LTCI):This program provides financial protection if you need long-term care, such as nursing home care or home health services.

- Life Insurance:The government offers life insurance to its employees, which can help protect your family financially if you pass away.

Eligibility for GS Pay and Health Benefits

To be eligible for GS Pay and health benefits, you must be a full-time federal employee.

- You must also meet certain eligibility requirements, such as being a U.S. citizen or national, and passing a background check.

How to Access GS Pay and Health Benefits Information

You can find more information about GS Pay and health benefits on the Office of Personnel Management (OPM) website.

- The OPM website provides detailed information about the GS Pay system, health benefits plans, and eligibility requirements.

GS Pay Components

The GS pay structure is designed to provide a fair and consistent salary system for federal employees. It is based on a series of pay scales, with each scale representing a different grade level and step. The higher the grade level, the more experience and responsibility the position requires, and the higher the salary.

Base Pay

Base pay is the foundation of your GS salary. It is determined by your grade level, step, and location. The GS pay scales are divided into 15 grades, each with 10 steps. The higher your grade and step, the higher your base pay.

For example, a GS-5, Step 1 employee would earn a lower base pay than a GS-12, Step 10 employee.

Performance Bonuses

Performance bonuses are an additional form of compensation that can be awarded to federal employees based on their job performance. These bonuses are not guaranteed and are awarded at the discretion of the agency.

Overtime Pay

Overtime pay is paid to employees who work more than 40 hours per week. The overtime rate is calculated at 1.5 times the employee’s regular hourly rate. For example, if an employee’s regular hourly rate is $20, their overtime rate would be $30 per hour.

GS Health Benefits Overview

Right, so, you’re probably wondering what’s up with GS’s health benefits, yeah? Basically, they’re like a safety net for your health, so you can chill knowing you’re covered if something goes down.GS offers a bunch of different health insurance plans, each with its own vibe and perks.

They’ve got medical, dental, and vision coverage, so you’re sorted from head to toe.

Medical Coverage

The medical plans are the big ones, and they’re designed to cover a wide range of medical expenses, like doctor’s visits, hospital stays, and even surgery. They’re all about keeping you healthy and sorted when you need it most. GS offers a range of medical plans, so you can pick the one that suits your needs and budget.

Understanding GS Pay and Health Benefits is crucial for any federal employee. This includes navigating the intricate GS Pay Scale, which determines your salary based on your position, experience, and location. For a detailed breakdown of the 2024 GS Pay Scale specifically tailored for Human Resources professionals, check out this comprehensive guide: GS Pay Scale 2024 for Human Resources: A Comprehensive Guide.

Armed with this knowledge, you can effectively assess your earning potential and make informed decisions about your career path within the federal government.

Some plans have lower premiums but might have higher deductibles, meaning you pay more out of pocket before the plan kicks in. Other plans have higher premiums but lower deductibles, so you pay less upfront. It’s all about finding the right balance for you.

Dental Coverage

Alright, let’s talk teeth. Dental plans are all about keeping your pearly whites gleaming. They cover checkups, cleanings, and even more complex procedures like fillings and crowns. You can choose a plan that suits your dental needs, whether you’re just looking for basic coverage or want something more comprehensive.

Vision Coverage

Vision plans are all about keeping your eyes sharp and clear. They cover things like eye exams, contact lenses, and even glasses. Some plans offer discounts on designer frames, so you can rock a stylish look while taking care of your peepers.

Types of Health Benefits

GS health plans are designed to cover a wide range of medical needs. Here’s a rundown of the main types of benefits you can expect:

- Medical Coverage: This covers a range of medical expenses, including doctor’s visits, hospital stays, and surgery.

- Dental Coverage: This covers dental checkups, cleanings, fillings, crowns, and other dental procedures.

- Vision Coverage: This covers eye exams, contact lenses, and glasses.

Enrolling in GS Health Benefits

So, you’re ready to get on board with GS health benefits? It’s like joining a club, but instead of fancy parties, you’re getting sorted with top-notch medical coverage. Let’s break down how to sign up and choose the right plan for you.

Enrollment Process

You’ll need to get your act together and sign up for GS health benefits within a specific timeframe. The enrollment period is usually a few weeks long, so don’t leave it until the last minute. You can sign up online, by phone, or by mail.

If you’re feeling extra fancy, you can even go to a GS enrollment center.

Choosing the Right Plan

Picking the right plan is like choosing your favourite flavour of ice creamyou want to get the best one for you! GS offers a range of plans, each with its own perks and price tag. To choose the right plan, you’ll need to consider things like your budget, your health needs, and your family situation.

- Budget:Some plans have higher premiums, but they might also offer lower co-pays and deductibles. Others have lower premiums, but they might have higher co-pays and deductibles. It’s a balancing act, so choose wisely!

- Health Needs:If you’re a healthy person, you might not need a plan with a lot of coverage. But if you have pre-existing conditions or you’re prone to getting ill, you might want to choose a plan with more coverage.

- Family Situation:If you have a family, you’ll need to choose a plan that covers everyone. Some plans offer family coverage at a discounted rate, so it’s worth checking out.

Enrollment Deadlines and Requirements

There are some deadlines and requirements you need to be aware of, so don’t go off the rails!

- Open Enrollment:This is the main enrollment period, and it’s usually a few weeks long. You can sign up for a plan during this time, even if you’re new to GS.

- Special Enrollment:If you have a life event, like getting married or having a baby, you might be eligible for a special enrollment period. This means you can sign up for a plan outside of the open enrollment period.

- Requirements:To enroll in GS health benefits, you’ll need to provide some basic information, such as your Social Security number and your date of birth. You’ll also need to provide information about your dependents, if you have any.

Understanding GS Health Benefits Costs

It’s crucial to understand the costs associated with GS health benefits to make informed decisions about your coverage. These costs can vary depending on the plan you choose and how much healthcare you use.

Understanding the Different Costs

The costs associated with GS health benefits are primarily made up of premiums, deductibles, and co-pays.

Understanding GS Pay and health benefits is crucial for anyone considering a career in the public sector. Knowing how the pay scale works and what benefits are available is essential for making informed decisions about your future. For IT professionals, specifically, Navigating the GS Pay Scale 2024: A Comprehensive Guide for IT Professionals provides valuable insights into the salary structure and potential career paths.

By carefully considering these factors, you can make an informed choice about your career goals and secure a fulfilling and financially rewarding future.

- Premiumsare monthly payments you make for your health insurance. They are usually deducted from your paycheck.

- Deductiblesare the amount you must pay out of pocket for healthcare services before your insurance starts covering the costs. You only have to pay your deductible once per year.

- Co-paysare fixed amounts you pay for specific healthcare services, like doctor’s visits or prescriptions. You pay a co-pay every time you use that service.

How Costs Vary, GS Pay and Health Benefits: What You Need to Know

The costs of premiums, deductibles, and co-pays can vary significantly based on the plan you choose.

- High Deductible Plans (HDPs)have lower premiums but higher deductibles. This means you pay less each month but more upfront for healthcare services.

- Low Deductible Plans (LDPs)have higher premiums but lower deductibles. This means you pay more each month but less upfront for healthcare services.

You can also expect to pay more for plans that offer more coverage, like plans that include dental and vision benefits.

Resources for Understanding Costs

The GS Office of Personnel Management (OPM) provides resources to help you understand your health benefit costs. You can find information about plan costs, coverage details, and how to choose the right plan for your needs.

- The OPM website has a comprehensive guide to GS health benefits, including information about costs.

- You can also contact the OPM directly for personalized assistance.

It’s essential to research and understand your health benefit costs to make informed decisions about your coverage.

Utilizing GS Health Benefits

So, you’ve got your GS health benefits sorted, but how do you actually use them? Don’t worry, it’s all pretty straightforward. This section will give you the lowdown on how to access and use your benefits, plus some real-life examples to help you understand how it all works.

Understanding GS pay and health benefits is crucial for any federal employee. As an administrative assistant, navigating the complexities of the GS pay scale can feel overwhelming, especially with the 2024 updates. Thankfully, resources like Navigating the GS Pay Scale 2024: A Comprehensive Guide for Administrative Assistants can provide valuable insights into salary expectations and potential benefits.

By understanding your potential earning power and the benefits available, you can make informed decisions about your career path and financial well-being.

Accessing and Using GS Health Benefits

You can access your GS health benefits through a few different channels. The most common way is through the official GS Health Benefits website. Here, you can find information on your plan, access your benefits, and even manage your claims.

You can also contact the GS Health Benefits hotline if you need help or have any questions.

Common Health Benefits Utilization Scenarios

Here are some common examples of how you might use your GS health benefits:

- Visiting a doctor:You’re feeling under the weather and need to see a doctor. You can use your GS health benefits to cover the cost of your appointment.

- Getting a prescription filled:You’ve been prescribed medication by your doctor. Your GS health benefits can help you cover the cost of your prescription.

- Going to the hospital:You’ve had an accident or need emergency medical care. Your GS health benefits can help you cover the cost of your hospital stay and treatment.

- Getting preventive care:You’re due for a check-up or need to get a flu shot. Your GS health benefits can help you cover the cost of these preventative services.

Resources Available to Help Employees

If you’re ever feeling lost or confused about your GS health benefits, there are a few resources available to help you out:

- GS Health Benefits website:This website is a great resource for finding information about your plan, accessing your benefits, and managing your claims.

- GS Health Benefits hotline:You can call the GS Health Benefits hotline if you have any questions or need help with your benefits.

- Your HR department:Your HR department can also provide you with information and support regarding your GS health benefits.

Additional Benefits and Resources

It’s not just about the pay and health insurance, babes! The GS offers a bunch of other perks to make your life easier and keep you feeling good. These benefits are designed to support your overall well-being, both inside and outside of work.

Employee Assistance Program (EAP)

This program provides confidential support for a wide range of personal and work-related issues. Think of it as your own personal cheerleader, ready to offer guidance and resources when you need them. They can help with things like:

- Stress management

- Work-life balance

- Financial planning

- Relationship issues

- Substance abuse

- Mental health concerns

EAPs are a lifeline, providing a safe space to talk about anything that’s on your mind.

Wellness Programs

The GS is all about keeping you healthy and happy, and their wellness programs are a great way to do just that. They offer a variety of resources to promote your physical, mental, and emotional well-being. Some common examples include:

- Fitness classes and gym discounts

- Healthy eating workshops

- Stress reduction techniques

- Mental health awareness campaigns

- Smoking cessation programs

These programs are a fantastic way to prioritize your health and feel your best, both at work and in your personal life.

Retirement Savings Plans

Saving for your future is important, and the GS offers various retirement plans to help you get started. These plans allow you to contribute a portion of your earnings to a fund that grows over time, providing financial security for your later years.

- 401(k) plans: These plans allow you to contribute pre-tax dollars to a retirement account, which can potentially grow tax-deferred.

- 403(b) plans: Similar to 401(k) plans, but typically offered by non-profit organizations and educational institutions.

- Pension plans: These plans provide a guaranteed income stream during retirement, based on your years of service and salary.

These plans offer a great way to plan for your future and secure your financial well-being.

Tuition Reimbursement Programs

Want to further your education? The GS understands the importance of continuous learning and may offer tuition reimbursement programs to support your professional development. This program can help you pay for courses or degrees related to your job, allowing you to gain new skills and advance your career.

Other Benefits

Besides the benefits mentioned above, the GS may offer other perks depending on your role and location. These can include:

- Life insurance

- Disability insurance

- Paid time off (vacation, sick leave, holidays)

- Employee discounts

- Transportation assistance

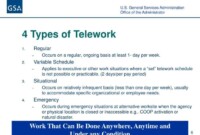

- Flexible work arrangements

These benefits are designed to make your work life easier and more enjoyable.

Importance of Resources

These resources are crucial for supporting employee well-being. They provide access to support, guidance, and tools that can help employees cope with stress, manage their health, and achieve their personal and professional goals. A happy and healthy workforce is a productive workforce, and the GS recognizes the importance of investing in its employees.

End of Discussion

As you navigate the landscape of GS Pay and Health Benefits, remember that knowledge is power. By understanding the intricacies of this system, you can make informed decisions that align with your needs and aspirations. Embrace the opportunity to secure your financial future and protect your health.

May this guide be your trusted companion, empowering you to navigate this journey with confidence.