GS Pay and Retirement Savings: Planning for the Future – GS Pay and Retirement Savings: Planning for a Secure Future is a crucial topic for federal employees, ensuring a comfortable and financially secure retirement. Understanding the intricacies of GS pay, including base salary, locality pay, and performance bonuses, is essential for creating a solid financial foundation.

Federal employees have access to various retirement savings plans, such as the Thrift Savings Plan (TSP) and the Federal Employees Retirement System (FERS), each offering unique features and benefits. Navigating these options effectively requires careful planning and informed decision-making, especially during the early stages of one’s career.

This comprehensive guide delves into the essential aspects of GS pay and retirement savings, providing insights and strategies to help federal employees make informed decisions about their financial future. From calculating retirement needs to optimizing investment strategies, this guide empowers readers to take control of their financial well-being and secure a comfortable retirement.

Understanding GS Pay and Retirement Savings: GS Pay And Retirement Savings: Planning For The Future

Planning for your financial future as a federal employee involves understanding your GS pay and retirement savings options. This knowledge empowers you to make informed decisions about your finances, ensuring a comfortable and secure future.

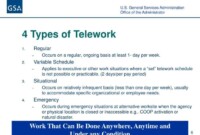

Components of GS Pay, GS Pay and Retirement Savings: Planning for the Future

Your GS pay, which stands for General Schedule pay, is the salary you receive as a federal employee. It is composed of several components that contribute to your overall compensation.

- Base Salary:This is the foundation of your GS pay, determined by your grade level and step within the GS pay scale. The GS pay scale is a standardized system that classifies federal positions based on their complexity and responsibility. Each grade level corresponds to a specific range of base salaries, with steps within each grade representing incremental increases in pay.

Your base salary increases as you gain experience and advance within your grade level.

- Locality Pay:This component adjusts your base salary based on the cost of living in your specific geographic location. Areas with higher costs of living, such as major metropolitan cities, have higher locality pay adjustments. This ensures that federal employees receive fair compensation that accounts for the varying costs of living across the country.

- Performance Bonuses:These bonuses are awarded to federal employees based on their individual performance evaluations. They are discretionary and may vary depending on your agency’s performance standards and budget. Performance bonuses provide an incentive for employees to excel in their work and contribute to the agency’s success.

Understanding your GS pay is crucial for planning your financial future, particularly retirement savings. As an IT professional, navigating the intricacies of the GS Pay Scale can be challenging, especially with the changes in 2024. Fortunately, a comprehensive guide like Navigating the GS Pay Scale 2024: A Comprehensive Guide for IT Professionals can help you understand your salary potential and make informed decisions about your retirement planning.

Federal Retirement Savings Plans

Federal employees have access to several retirement savings plans that provide financial security for their future. These plans offer different features and benefits, allowing you to choose the one that best suits your individual needs and financial goals.

- Thrift Savings Plan (TSP):The TSP is a tax-deferred savings plan that allows you to contribute a portion of your salary to a retirement account. The TSP is similar to a 401(k) plan in the private sector, offering a variety of investment options, including stock funds, bond funds, and a government securities fund.

The TSP offers several advantages, including tax-deferred growth, matching contributions from the government, and the potential for significant long-term savings.

- Federal Employees Retirement System (FERS):FERS is a defined-benefit pension plan that provides a guaranteed retirement income based on your years of service and salary. FERS is designed to provide a stable and predictable income stream during retirement. In addition to the pension, FERS also includes a component similar to the TSP, allowing you to make additional contributions to your retirement savings.

Importance of Understanding Your GS Pay and Retirement Savings Options

Understanding your GS pay and retirement savings plan options early in your career is crucial for building a secure financial future.

“It’s never too early to start planning for retirement. The earlier you begin saving, the more time your money has to grow.”

Knowing the components of your GS pay and the features of different retirement savings plans allows you to make informed decisions about your finances. This knowledge empowers you to:

- Set realistic financial goals:Understanding your income and potential retirement benefits allows you to establish achievable financial targets for your future.

- Make informed decisions about your savings:By comparing the different retirement savings plans, you can choose the option that aligns with your individual needs and financial goals.

- Maximize your retirement savings:Knowing the contribution limits and matching programs offered by different plans allows you to optimize your retirement savings potential.

Planning for Retirement

Retirement planning is a crucial aspect of financial well-being, ensuring a comfortable and fulfilling life after your working years. It involves carefully considering your financial goals, lifestyle preferences, and potential expenses to create a plan that meets your needs.

Calculating Retirement Needs

To determine how much you need to save for retirement, you must consider several factors. These include your desired lifestyle, expected expenses, and life expectancy.

- Desired Lifestyle:Imagine your ideal retirement life. What activities do you envision yourself doing? What kind of living arrangements do you prefer? Do you plan to travel, pursue hobbies, or volunteer? Based on your desired lifestyle, estimate your monthly expenses.

- Expected Expenses:Consider the costs associated with your desired lifestyle, including housing, healthcare, transportation, food, and entertainment. Research average expenses in your desired retirement location and adjust based on your individual preferences.

- Life Expectancy:While it’s impossible to predict your exact lifespan, you can use average life expectancies as a guideline. Consider factors like your family history, health habits, and lifestyle choices. Use online calculators or consult a financial advisor to estimate your life expectancy.

Maximizing Retirement Savings Contributions

To reach your retirement goals, maximizing contributions to your retirement savings accounts is essential. This includes the Thrift Savings Plan (TSP) and other retirement accounts like 401(k)s or IRAs.

- TSP Contributions:The TSP offers a variety of investment options, allowing you to customize your portfolio based on your risk tolerance and investment goals. Maximize your contributions to the TSP, taking advantage of the matching contributions offered by the government.

GS Pay offers a structured salary system, providing a predictable income stream that’s crucial for long-term financial planning. Understanding the intricacies of the GS Pay Scale is vital for administrative assistants, as it helps them navigate salary expectations and career progression.

For a comprehensive breakdown of the GS Pay Scale for 2024, specifically tailored for administrative assistants, check out Navigating the GS Pay Scale 2024: A Comprehensive Guide for Administrative Assistants. This knowledge empowers you to make informed decisions about your career path and retirement savings, ensuring a secure financial future.

- Other Retirement Accounts:Explore other retirement savings accounts like 401(k)s or IRAs, which offer tax advantages and potential employer matching contributions.

Managing Inflation Risk

Inflation erodes the purchasing power of your savings over time, meaning that the same amount of money will buy less in the future. Consider these strategies to manage inflation risk:

- Invest in Inflation-Protected Assets:Consider investments that are designed to keep pace with inflation, such as Treasury Inflation-Protected Securities (TIPS) or real estate.

- Diversify Your Portfolio:Diversifying your investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate the impact of inflation on your overall portfolio.

- Adjust Your Spending:As inflation rises, you may need to adjust your spending habits to maintain your desired lifestyle. This could involve finding ways to reduce unnecessary expenses or finding alternative sources of income.

Investment Strategies for Retirement Savings

Investing your TSP contributions wisely is crucial to building a comfortable retirement. The TSP offers a variety of investment options, each with its own risk and return profile. Understanding these options and choosing an investment strategy that aligns with your risk tolerance, time horizon, and financial goals is essential.

TSP Investment Options

The TSP offers a range of investment options, allowing you to diversify your portfolio and potentially enhance your returns. Here are some of the most common investment options:

- G Fund:This is a fixed-income investment option, providing a guaranteed return based on the interest rate on U.S. Treasury securities. It’s considered the safest option with minimal risk, but it also has the lowest potential return.

- F Fund:This investment option invests in a portfolio of U.S. Treasury bonds, providing a higher potential return than the G Fund but with slightly more risk.

- C Fund:This investment option invests in a broad range of common stocks, providing a higher potential return than the F Fund but with greater risk. The C Fund mirrors the performance of the S&P 500 Index, a benchmark for U.S. stocks.

- S Fund:This investment option invests in a portfolio of small-cap stocks, providing a higher potential return than the C Fund but with even greater risk. It focuses on companies with smaller market capitalizations, which tend to be more volatile than large-cap stocks.

- I Fund:This investment option invests in a portfolio of international stocks, offering diversification beyond U.S. markets. It can provide higher potential returns, but also carries greater risk due to currency fluctuations and global economic factors.

- L Fund:This investment option invests in a mix of stocks and bonds, providing a balanced approach with moderate risk and potential return. It’s designed for investors who want to spread their investments across different asset classes.

- Mutual Funds:The TSP also offers a selection of mutual funds, allowing you to invest in specific sectors or asset classes, such as real estate, emerging markets, or fixed income. Mutual funds provide diversification within a specific investment category.

Risk and Return Considerations

Each investment option within the TSP has a different risk profile and potential return. Risk refers to the possibility of losing money, while return refers to the potential for profit.

GS Pay and retirement savings are essential components of financial planning for the future. Understanding the intricacies of the GS Pay Scale can significantly impact your retirement planning. For comprehensive information on the 2024 GS Pay Scale for Human Resources, consult GS Pay Scale 2024 for Human Resources: A Comprehensive Guide.

Armed with this knowledge, you can make informed decisions about your salary and retirement savings, ensuring a comfortable and secure future.

- Risk-Averse Investors:Investors who are averse to risk might prefer options like the G Fund or F Fund, which offer lower potential returns but also lower risk. They may prioritize preserving their capital and minimizing potential losses.

- Risk-Tolerant Investors:Investors who are more comfortable with risk might consider options like the C Fund, S Fund, or I Fund, which have the potential for higher returns but also greater risk. They may be willing to accept higher volatility in exchange for potentially higher returns.

Sample Investment Portfolios

The optimal investment strategy depends on your individual circumstances, including your risk tolerance, time horizon, and financial goals. Here are some sample investment portfolios tailored for different risk tolerance levels and time horizons:

- Conservative Portfolio:For investors with a low risk tolerance and a long time horizon, a conservative portfolio might allocate a higher percentage to the G Fund and F Fund, with a smaller allocation to the C Fund or L Fund. This strategy emphasizes safety and capital preservation.

- Moderate Portfolio:For investors with a moderate risk tolerance and a long time horizon, a moderate portfolio might allocate a larger percentage to the C Fund and L Fund, with smaller allocations to the G Fund and F Fund. This strategy balances potential returns with risk management.

- Aggressive Portfolio:For investors with a high risk tolerance and a long time horizon, an aggressive portfolio might allocate a larger percentage to the C Fund, S Fund, and I Fund, with smaller allocations to the G Fund and F Fund. This strategy emphasizes growth potential but carries greater risk.

Remember:Investment strategies should be reviewed and adjusted periodically to reflect changes in your circumstances, risk tolerance, and financial goals. Consult with a financial advisor for personalized guidance on your TSP investment strategy.

Tax Considerations for Retirement Savings

Understanding the tax implications of contributing to and withdrawing from retirement savings plans is crucial for maximizing your retirement savings and minimizing your tax burden. This section explores the tax advantages of retirement savings plans, the differences between Roth and traditional accounts, and strategies for optimizing your retirement savings.

Tax Implications of Contributions and Withdrawals

Retirement savings plans offer tax advantages, but these advantages vary depending on the type of plan and how you choose to contribute.

- Traditional IRA and 401(k) contributions:Contributions to traditional IRAs and 401(k)s are typically tax-deductible, meaning you can reduce your taxable income by the amount you contribute. This can result in lower taxes in the current year. However, withdrawals in retirement are taxed as ordinary income.

- Roth IRA and 401(k) contributions:Contributions to Roth IRAs and 401(k)s are not tax-deductible, but withdrawals in retirement are tax-free. This means you pay taxes on your contributions upfront, but you won’t have to pay taxes on your withdrawals in retirement.

- Traditional IRA and 401(k) withdrawals:When you withdraw money from a traditional IRA or 401(k) in retirement, the withdrawals are taxed as ordinary income. This means that you will pay taxes on the money you withdraw at your ordinary income tax rate.

- Roth IRA and 401(k) withdrawals:Withdrawals from Roth IRAs and 401(k)s in retirement are tax-free, as long as you meet certain requirements. These requirements typically include being at least 59 1/2 years old and having had the account for at least five years.

Roth vs. Traditional Retirement Accounts

Choosing between a Roth and a traditional retirement account depends on your individual circumstances and financial goals.

- Roth IRA/401(k):This option is generally preferred by individuals who expect to be in a higher tax bracket in retirement than they are currently. By paying taxes upfront on contributions, you avoid paying taxes on withdrawals in retirement, potentially at a higher rate.

- Traditional IRA/401(k):This option is generally preferred by individuals who expect to be in a lower tax bracket in retirement than they are currently. By deducting contributions from your taxable income, you can lower your current tax liability, and you’ll pay taxes on withdrawals in retirement, potentially at a lower rate.

Tax Planning Strategies for Retirement Savings

Tax planning is essential for optimizing your retirement savings.

- Maximize tax-advantaged contributions:Take advantage of tax deductions and credits available for retirement savings.

- Consider a Roth conversion:If you have a traditional IRA or 401(k) and expect to be in a higher tax bracket in retirement, you might consider converting it to a Roth IRA. This allows you to pay taxes on the conversion amount now, but your withdrawals in retirement will be tax-free.

- Withdrawals from retirement accounts:Carefully consider the tax implications of withdrawing money from your retirement accounts. If you need to withdraw money before age 59 1/2, you may be subject to a 10% early withdrawal penalty, as well as ordinary income taxes.

Tax-Advantaged Retirement Accounts

Retirement accounts offer tax advantages, but these advantages vary depending on the type of plan and how you choose to contribute.

- 401(k):A 401(k) is a retirement savings plan offered by employers. Contributions are typically made through payroll deductions, and the money grows tax-deferred.

- 403(b):A 403(b) is a retirement savings plan offered by certain non-profit organizations, such as schools and hospitals. Contributions are similar to 401(k)s, with tax-deferred growth.

- Traditional IRA:A traditional IRA is a retirement savings plan that individuals can set up on their own. Contributions are typically tax-deductible, and the money grows tax-deferred.

- Roth IRA:A Roth IRA is a retirement savings plan that individuals can set up on their own. Contributions are not tax-deductible, but withdrawals in retirement are tax-free.

Retirement Planning Resources and Tools

Navigating the world of retirement planning can feel overwhelming, but there are valuable resources available to guide you. Understanding these resources and tools empowers you to make informed decisions about your future financial security.

Government Websites

The government offers a wealth of information and tools to assist federal employees in their retirement planning journey.

- The U.S. Office of Personnel Management (OPM)website provides comprehensive information about the Federal Employees Retirement System (FERS) and the Civil Service Retirement System (CSRS). It includes details on benefits, contributions, and retirement planning calculators.

- The Social Security Administration (SSA)website offers information about Social Security benefits, including retirement benefits. You can use their calculators to estimate your future benefits based on your earnings history.

- The Internal Revenue Service (IRS)website provides information on tax-advantaged retirement savings plans, such as 401(k)s and Roth IRAs, as well as tax implications related to retirement income.

Financial Advisors

Seeking professional advice from a financial advisor can provide personalized guidance and support in your retirement planning.

- Federal Employee Education and Assistance Fund (FEEA)offers financial counseling services to federal employees, including retirement planning. They can provide personalized advice on investment strategies, retirement income planning, and other financial matters.

- The Thrift Savings Plan (TSP)offers free financial counseling services to participants. They can help you understand your TSP options, develop a personalized investment strategy, and make informed decisions about your retirement savings.

- Private financial advisorscan also provide comprehensive retirement planning services, including investment management, tax planning, and estate planning. It is important to choose a qualified and experienced advisor who understands the unique needs of federal employees.

Retirement Planning Tools

Retirement planning tools can help you visualize your future financial situation, estimate your retirement needs, and track your progress.

| Tool | Features | Benefits |

|---|---|---|

| OPM Retirement Planner | Estimates your future retirement benefits based on your current salary, years of service, and other factors. | Provides a clear picture of your potential retirement income and helps you make informed decisions about your retirement plans. |

| TSP Retirement Planner | Simulates different retirement scenarios based on your investment choices, contribution rates, and estimated expenses. | Allows you to experiment with different investment strategies and assess their impact on your retirement savings. |

| Social Security Retirement Estimator | Estimates your future Social Security benefits based on your earnings history. | Helps you understand your potential Social Security income and plan accordingly. |

Financial Literacy Programs and Workshops

Federal agencies and organizations offer financial literacy programs and workshops to educate employees about retirement planning and other financial topics.

- OPM’s Federal Employee Benefits Libraryprovides a variety of resources, including webinars and workshops, on retirement planning and other financial topics.

- FEEAoffers a range of financial literacy programs, including workshops on retirement planning, budgeting, and debt management.

- TSPconducts workshops and seminars on topics such as investment strategies, asset allocation, and retirement income planning.

Final Wrap-Up

By understanding GS pay, exploring different retirement savings plans, and adopting effective investment strategies, federal employees can pave the way for a financially secure and fulfilling retirement. Remember, taking proactive steps early on and seeking guidance from financial professionals can significantly impact your long-term financial success.

A well-planned retirement strategy is not just about accumulating wealth; it’s about creating a future that aligns with your goals and aspirations, allowing you to enjoy the fruits of your labor in your golden years.