Navigating the complexities of federal compensation can be daunting, but understanding the General Schedule (GS) Pay Scale is crucial for federal employees. The GS Pay Scale determines the salaries of millions of federal workers, and its annual adjustments have a significant impact on their financial well-being.

This guide will provide a comprehensive overview of the GS Pay Scale 2024, empowering federal employees with the knowledge they need to plan their careers and secure their financial futures.

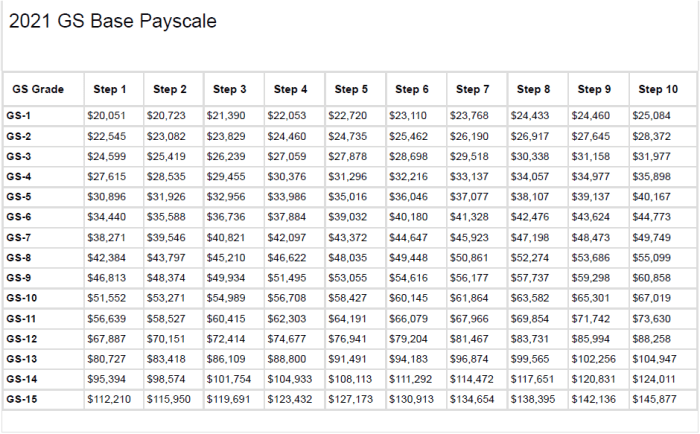

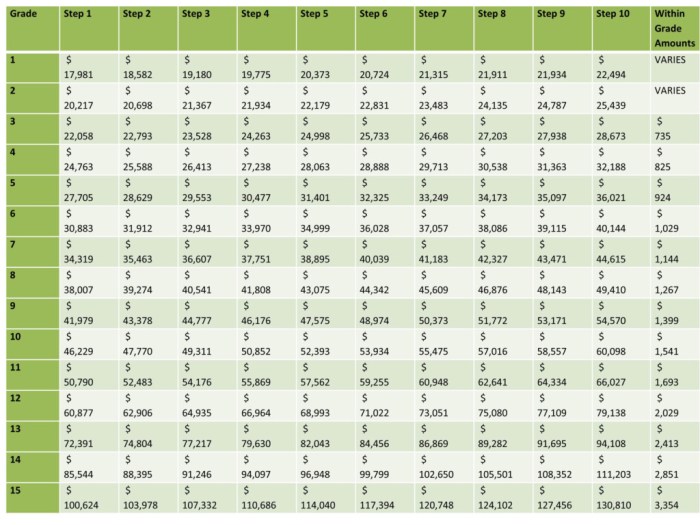

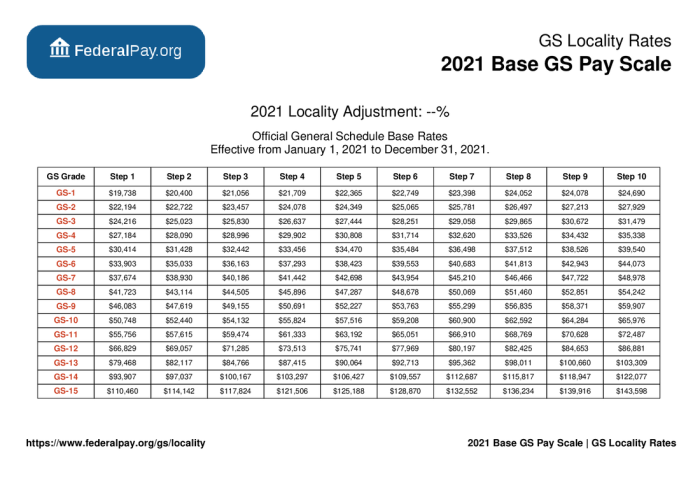

The GS Pay Scale is a structured system that categorizes federal positions based on their duties and responsibilities. Each grade level within the GS Pay Scale corresponds to a specific range of salaries, known as steps. Locality pay differentials and special pay adjustments further modify base salaries to account for geographic location and job-specific factors.

Understanding these components is essential for federal employees to maximize their earning potential.

GS Pay Scale Overview

The General Schedule (GS) Pay Scale is a system used to determine the salaries of federal civilian employees in the United States. It is designed to ensure that federal employees are compensated fairly and consistently for their work.

The GS Pay Scale is divided into 15 grades, each of which is further divided into 10 steps. The grade of a position is determined by the level of difficulty and responsibility of the work performed, while the step within a grade is determined by the employee’s length of service and performance.

Pay Bands

The GS Pay Scale is divided into five pay bands, each of which represents a different level of responsibility and compensation. The pay bands are as follows:

- Band 1: Entry-level positions

- Band 2: Journeyman-level positions

- Band 3: Senior-level positions

- Band 4: Supervisory-level positions

- Band 5: Executive-level positions

2024 Pay Scale Adjustments

The annual pay scale adjustments for General Schedule (GS) federal employees are determined through a process involving multiple factors. The adjustments are based on the Employment Cost Index (ECI), which measures changes in private-sector wages and benefits, and on the locality pay comparability data collected by the Bureau of Labor Statistics.

The ECI is a measure of the change in the cost of wages and benefits for civilian workers in the private sector. It is used to determine the overall increase in the GS pay scale. The locality pay comparability data is used to adjust the GS pay scale for specific geographic areas based on the cost of living in those areas.

Factors Considered in Setting the 2024 GS Pay Scale

The following factors were considered in setting the 2024 GS Pay Scale:

- The Employment Cost Index (ECI)

- The locality pay comparability data

- The President’s budget request

- The recommendations of the Federal Salary Council

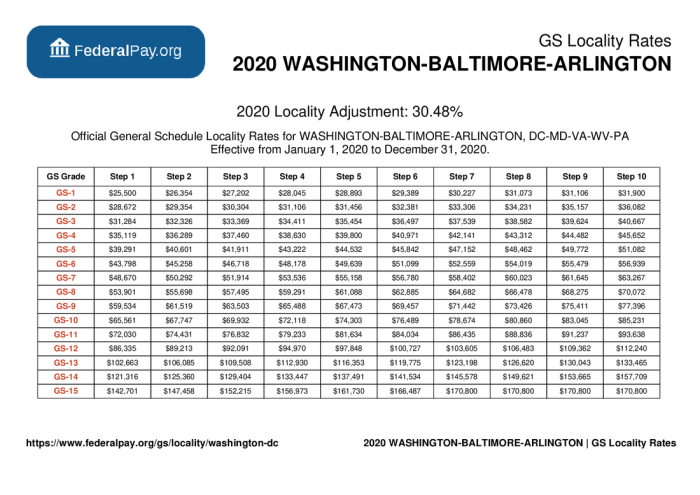

Locality Pay Differentials

Locality pay differentials are adjustments to the base pay of federal employees to account for the varying costs of living in different geographic areas. These differentials are designed to ensure that federal employees receive comparable pay for the same work, regardless of where they are located.

The factors used to determine locality pay adjustments include:

- Housing costs

- Transportation costs

- Other living expenses, such as food and utilities

The following map shows the locality pay differentials for different geographic areas:

[Map or table showing locality pay differentials for different geographic areas]

Special Pay Adjustments

Special pay adjustments are additional compensation provided to federal employees who perform duties that involve unusual risks, hardships, or special skills. These adjustments are intended to compensate employees for the extra effort, expertise, or hazards associated with their work.

Eligibility Criteria and Application Process

Eligibility for special pay adjustments varies depending on the type of adjustment. Generally, employees must meet specific job requirements, demonstrate proficiency in the required skills, or be exposed to specific hazards or working conditions. Employees must apply for special pay adjustments through their supervisors or human resources department.

The application process typically involves submitting supporting documentation, such as performance evaluations, training certificates, or medical records.

Types of Special Pay Adjustments

There are various types of special pay adjustments available to federal employees, including:

- Hazardous duty pay: Compensates employees for performing duties in areas where there is a risk of injury, illness, or death.

- Language proficiency pay: Compensates employees who are proficient in foreign languages and use those skills in their work.

- Overtime pay: Compensates employees for working hours beyond their regular work schedule.

- Sunday premium pay: Compensates employees for working on Sundays.

- Night differential pay: Compensates employees for working during evening or overnight hours.

Impact on Federal Employees

The 2024 GS Pay Scale adjustments will have a significant impact on federal employees. The changes will affect employees’ salaries, benefits, and retirement contributions. It is important for federal employees to understand the potential impact of these changes and to prepare accordingly.The

pay scale adjustments will vary depending on an employee’s pay grade and locality. Employees in higher pay grades will generally receive a larger percentage increase than employees in lower pay grades. Employees in localities with a higher cost of living will also receive a larger percentage increase than employees in localities with a lower cost of living.The

pay scale adjustments will have a number of implications for federal employees. For example, employees may need to adjust their budgets to account for the changes in their salaries. Employees may also need to make changes to their retirement plans to account for the changes in their contributions.Federal

employees can prepare for the pay scale changes by taking the following steps:* Reviewing the new pay scale and calculating how it will affect their salary

- Adjusting their budget to account for the changes in their salary

- Making changes to their retirement plan to account for the changes in their contributions

- Consulting with a financial advisor to discuss their options

Comparison to Private Sector Salaries

The GS Pay Scale provides competitive salaries for federal employees, but how does it compare to salaries in the private sector? Let’s analyze the factors that contribute to differences in pay between these two sectors.

Factors Contributing to Differences in Pay

*

-*Job Responsibilities

Federal employees often have specialized skills and responsibilities that may not be easily comparable to private sector positions.

-

-*Government Benefits

Federal employees receive generous benefits, including health insurance, retirement plans, and paid time off, which can offset lower salaries.

-*Unionization

Many federal employees are unionized, which can influence salaries and working conditions.

-*Geographic Location

Pay rates can vary based on the location of the federal job, similar to private sector salaries.

-*Experience and Education

As in the private sector, experience and education play a significant role in determining salary levels for federal employees.

Implications for Federal Employees

Federal employees seeking comparable salaries in the private sector may need to consider the following:*

-*Negotiation

They may need to negotiate higher salaries to match their private sector counterparts, especially if their skills and experience are in high demand.

-

-*Skill Development

Acquiring specialized skills and certifications can increase earning potential in both the public and private sectors.

-*Relocation

Moving to a location with higher private sector salaries may be an option for federal employees seeking higher pay.

Retirement and Benefits

The GS Pay Scale directly influences retirement and benefits for federal employees.

Adjustments to the pay scale impact pension calculations and health insurance premiums. Understanding these implications is crucial for effective retirement planning.

Pension Calculations

Federal employees participate in the Federal Employees Retirement System (FERS) or the Civil Service Retirement System (CSRS). The amount of pension received is based on a formula that considers years of service, average salary, and age at retirement. Pay scale adjustments increase the average salary used in this calculation, potentially leading to higher pension benefits.

Health Insurance Premiums

Federal employees contribute a portion of their salaries towards health insurance premiums. Pay scale adjustments can result in increased premium payments as salaries rise. Employees should be aware of these potential costs and plan accordingly.

Retirement Planning

In light of pay scale changes, federal employees should proactively plan for retirement. Consider the following strategies:

-

-*Contribute to Thrift Savings Plan (TSP)

Take advantage of the TSP, a tax-advantaged retirement savings plan. Pay scale adjustments can increase contributions, maximizing retirement savings.

-*Explore Roth Accounts

Consider converting traditional IRAs to Roth IRAs, allowing for tax-free withdrawals in retirement.

-*Increase Savings Rate

Dedicate a higher percentage of income to retirement savings to supplement pension benefits.

-*Consider Part-Time Work

Continue working part-time in retirement to supplement income and maintain health insurance coverage.

By understanding the impact of the GS Pay Scale on retirement and benefits, federal employees can make informed decisions and plan effectively for their financial future.

Historical Perspective

The General Schedule (GS) Pay Scale has undergone significant adjustments throughout its history. Initially established in 1949, the GS Pay Scale has been revised periodically to reflect changes in the cost of living, economic conditions, and the labor market. These adjustments have had a direct impact on the salaries and benefits of federal employees.

Past Pay Scale Adjustments

Over the years, the GS Pay Scale has been adjusted numerous times to keep pace with inflation and ensure that federal employees are fairly compensated. Some notable adjustments include:

- In 1970, the GS Pay Scale was increased by an average of 6%, marking the largest single-year increase in history.

- In 1981, the GS Pay Scale was frozen for the first time, as part of President Reagan’s economic austerity measures.

- In 1990, the GS Pay Scale was increased by an average of 4.1%, the largest increase since 1970.

- In 2001, the GS Pay Scale was increased by an average of 4.6%, the largest increase in a decade.

- In 2023, the GS Pay Scale was increased by an average of 4.6%, the largest increase since 2001.

Impact on Federal Employees

The adjustments to the GS Pay Scale have had a significant impact on the salaries and benefits of federal employees. The regular revisions have helped to ensure that federal employees receive fair compensation for their work and maintain a standard of living commensurate with their experience and responsibilities.

Trends in GS Pay Scale Adjustments

Over time, there has been a trend towards larger GS Pay Scale adjustments. This is due to a number of factors, including rising inflation, increased competition for skilled workers, and a growing recognition of the importance of federal employees to the nation’s economy and security.

Summary

The GS Pay Scale 2024 represents a crucial aspect of federal employment, affecting the financial well-being of millions of dedicated individuals. By staying informed about the pay scale adjustments, locality pay differentials, and special pay opportunities, federal employees can optimize their compensation and plan for their future financial security.

This guide has provided a comprehensive overview of the GS Pay Scale 2024, empowering federal employees with the knowledge they need to navigate the complexities of federal compensation and make informed decisions about their careers.