The General Schedule (GS) Pay Scale serves as a cornerstone for determining the compensation of healthcare professionals in the United States. Understanding its intricacies is paramount for navigating career advancement and ensuring fair remuneration. This comprehensive guide will delve into the nuances of the GS Pay Scale 2024, empowering healthcare professionals with the knowledge to maximize their earning potential.

The GS Pay Scale has a rich history, evolving over time to reflect the changing landscape of the healthcare industry. Its structure and purpose will be explored, providing a solid foundation for understanding the mechanics of pay determination for healthcare professionals.

Overview of GS Pay Scale 2024 for Healthcare Professionals

The General Schedule (GS) Pay Scale is a standardized system used by the United States federal government to determine the salaries of its employees. It is particularly significant for healthcare professionals, as it provides a structured framework for their compensation based on their qualifications, experience, and performance.

The GS Pay Scale has evolved over time to reflect changes in the job market and the increasing complexity of federal government operations. It was first established in 1949 and has undergone several revisions since then to ensure its relevance and fairness.

Purpose and Structure of the GS Pay Scale

The primary purpose of the GS Pay Scale is to ensure equitable compensation for federal employees based on their job responsibilities and performance. It is designed to attract and retain qualified individuals in various fields, including healthcare, by providing competitive salaries and benefits.

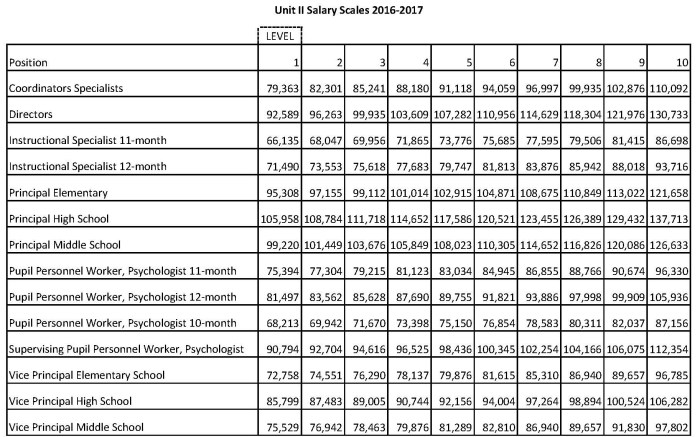

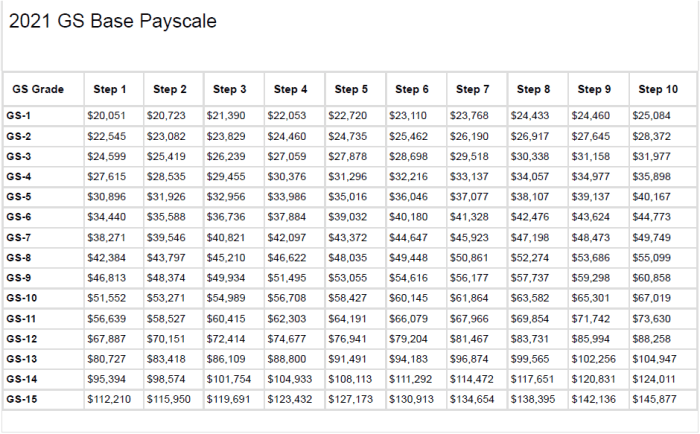

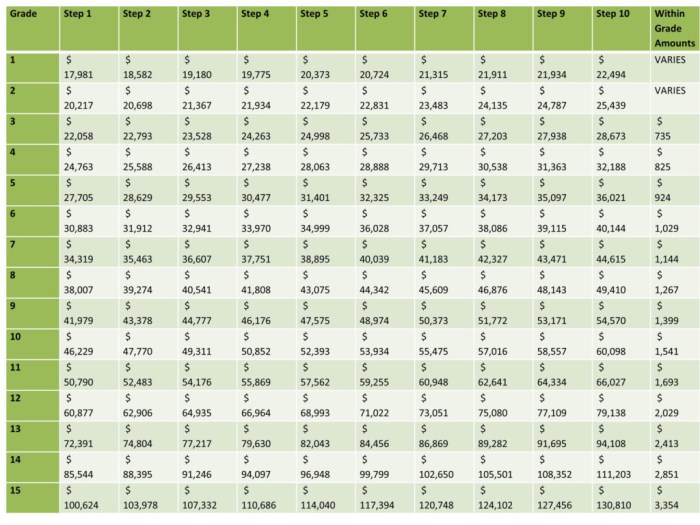

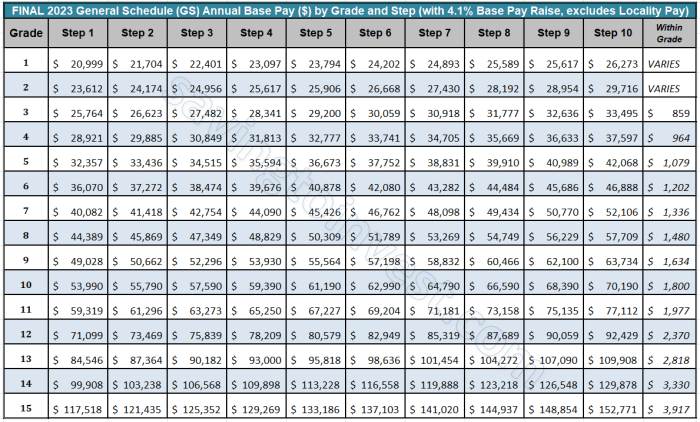

The GS Pay Scale consists of 15 grades, each with 10 steps. Each grade represents a different level of responsibility and complexity, and the steps within each grade reflect increments in experience and performance. The grade and step an employee is assigned to determine their base salary.

Pay Scale Structure

The GS Pay Scale for healthcare professionals is a standardized system that determines the salaries of federal employees based on their grade and step within the scale.

The GS Pay Scale consists of 15 grades, each with 10 steps. The grade level is determined by the complexity of the work performed, while the step within the grade is based on the employee’s years of experience and performance.

Grade Levels

The grade levels are numbered from GS-1 to GS-15, with GS-1 being the lowest grade and GS-15 being the highest. The higher the grade level, the more complex the work and the higher the salary.

Steps Within a Grade

Within each grade, there are 10 steps. The step level is determined by the employee’s years of experience and performance. The higher the step level, the more experience the employee has and the higher the salary.

Factors Influencing Pay Scale Adjustments

The GS Pay Scale is adjusted periodically to keep pace with inflation and changes in the labor market. The Office of Personnel Management (OPM) is responsible for making these adjustments.

Locality Pay Adjustments

Locality pay adjustments are geographical differentials added to the base pay of federal employees to account for varying living costs in different regions of the United States. These adjustments ensure that federal employees receive equitable compensation regardless of their location.

The Office of Personnel Management (OPM) determines locality pay adjustments based on a comprehensive survey of housing, transportation, and other living expenses in each locality. The survey data is then used to establish locality pay areas, which are groups of counties or metropolitan areas with similar living costs.

Factors that Determine Locality Pay Adjustments

- Housing costs: The cost of housing, including rent, mortgages, and property taxes, is a major factor in determining locality pay adjustments.

- Transportation costs: The cost of transportation, including public transportation, gasoline, and vehicle maintenance, is also considered.

- Other living expenses: Other living expenses, such as food, clothing, healthcare, and entertainment, are also factored in.

Examples of Locality Pay Adjustments for Healthcare Professionals

- A nurse working in San Francisco, California, which is in locality pay area 20, receives a locality pay adjustment of 23.54%.

- A physician working in Boise, Idaho, which is in locality pay area 14, receives a locality pay adjustment of 10.08%.

Step Increases and Promotions

Within the GS Pay Scale, healthcare professionals can advance their careers through step increases and promotions.

Step increases are automatic salary adjustments based on years of service within a grade. Each grade has 10 steps, and employees typically receive a step increase every year until they reach the top step of their grade.

Promotions

Promotions involve moving to a higher grade within the GS Pay Scale. Promotions are based on merit and are typically awarded after employees have demonstrated exceptional performance in their current role.

To be eligible for a promotion, employees must meet the minimum qualifications for the higher grade, which include education, experience, and skills.

Healthcare professionals can advance their careers by seeking out opportunities for professional development, networking with colleagues, and taking on leadership roles.

Benefits and Allowances

In addition to their base salary, healthcare professionals under the GS Pay Scale are eligible for a range of benefits and allowances that enhance their overall compensation. These benefits and allowances are designed to provide financial support, improve work-life balance, and ensure the well-being of healthcare professionals.Eligibility

requirements and application processes vary for different benefits and allowances. It is important for healthcare professionals to familiarize themselves with the specific requirements and procedures to maximize their benefits package.

Health and Dental Insurance

Healthcare professionals are eligible for comprehensive health and dental insurance plans that cover a wide range of medical, dental, and vision care services. These plans offer various coverage options and deductibles to meet the needs of individuals and families.

Retirement Savings Plan

Healthcare professionals are automatically enrolled in the Federal Employees Retirement System (FERS), a defined benefit pension plan. FERS provides retirement income based on years of service and salary history. Healthcare professionals can also contribute to a voluntary Thrift Savings Plan (TSP), a 401(k)-style savings plan with employer matching contributions.

Paid Time Off

Healthcare professionals are entitled to paid time off, including annual leave, sick leave, and family and medical leave. Annual leave accrues based on years of service, and can be used for vacation, personal business, or other purposes. Sick leave is available for short-term illnesses or injuries.

Family and medical leave provides unpaid leave for certain family and medical events, such as the birth or adoption of a child, or the care of a seriously ill family member.

Life Insurance

Healthcare professionals are covered by a basic life insurance policy that provides a lump sum benefit to beneficiaries in the event of death. Additional life insurance coverage can be purchased through voluntary programs.

Flexible Spending Accounts

Healthcare professionals can establish flexible spending accounts (FSAs) to set aside pre-tax dollars for qualified healthcare expenses, such as medical, dental, or vision care costs. FSAs can help reduce overall healthcare costs and increase take-home pay.

Impact on Overall Compensation

The benefits and allowances available to healthcare professionals under the GS Pay Scale significantly enhance their overall compensation. These benefits and allowances provide financial security, improve work-life balance, and ensure the well-being of healthcare professionals. By understanding the eligibility requirements and application processes for these benefits and allowances, healthcare professionals can maximize their compensation package and secure a rewarding career in the healthcare field.

Comparison to Other Pay Scales

The GS Pay Scale for Healthcare Professionals is comparable to other pay scales in the healthcare industry. It offers competitive salaries and benefits, but there are some strengths and weaknesses to consider.

One of the strengths of the GS Pay Scale is that it is based on a standardized system. This means that healthcare professionals with the same qualifications and experience will receive the same pay, regardless of their location or employer.

This can be beneficial for healthcare professionals who are looking for a stable and predictable salary.

Strengths of the GS Pay Scale

- Standardized system ensures equal pay for equal work.

- Competitive salaries and benefits compared to other pay scales.

- Step increases and promotions provide opportunities for salary growth.

Weaknesses of the GS Pay Scale

- May not be as competitive as private sector salaries in some areas.

- Locality pay adjustments can lead to disparities in pay between different regions.

- Limited opportunities for overtime pay or bonuses.

Ultimately, the implications of pay scale differences for healthcare professionals depend on their individual circumstances and career goals. Those who are looking for a stable and predictable salary may find the GS Pay Scale to be a good option. However, those who are looking for the highest possible salary may want to consider working in the private sector.

Last Recap

In conclusion, the GS Pay Scale 2024 offers a transparent and structured framework for determining the compensation of healthcare professionals. By understanding the pay scale’s components, factors influencing adjustments, and opportunities for advancement, healthcare professionals can effectively navigate their careers and secure the remuneration they deserve.

This guide has provided a comprehensive overview of the GS Pay Scale, empowering healthcare professionals with the knowledge and tools to optimize their financial well-being.