In the realm of federal employment, the GS Pay Scale serves as a roadmap for determining salaries and career progression for Administrative Assistants. This intricate system encompasses a multitude of factors, including locality, performance, and career advancement. Understanding the nuances of the GS Pay Scale is essential for Administrative Assistants seeking to maximize their earning potential and navigate their careers within the federal government.

This comprehensive guide will delve into the intricacies of the GS Pay Scale 2024, empowering Administrative Assistants with the knowledge and insights they need to make informed decisions about their salaries and career paths. From understanding the basics of salary determination to exploring career progression opportunities and benefits, this guide will serve as an invaluable resource for Administrative Assistants.

GS Pay Scale 2024 for Administrative Assistants

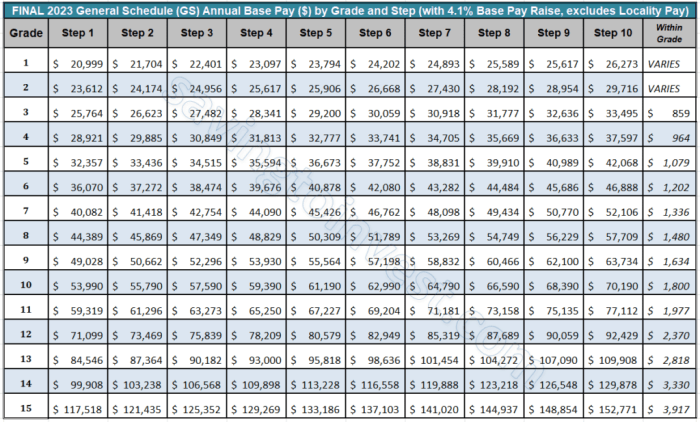

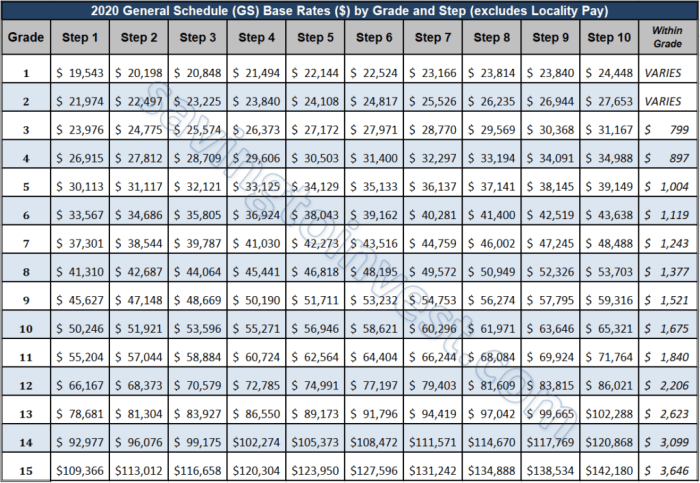

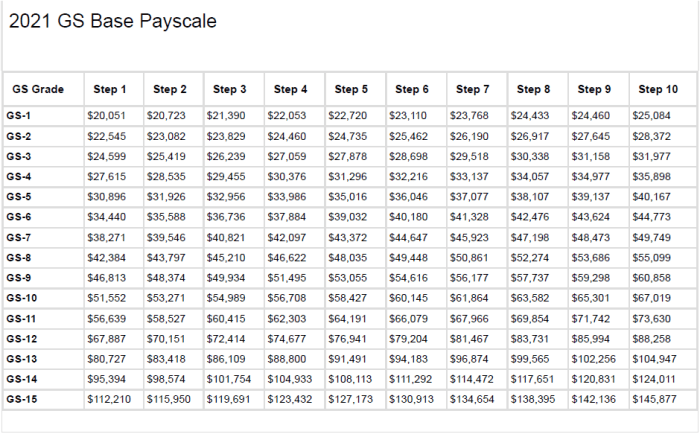

The GS Pay Scale is a standardized compensation system used by the United States government to determine the salaries of federal employees. The General Schedule (GS) is divided into 15 grades, with each grade representing a different level of responsibility and experience.

Administrative Assistants are typically classified under the GS-5 to GS-9 grades, depending on their duties and qualifications.

The GS Pay Scale is updated annually to reflect changes in the cost of living and to ensure that federal employees are compensated fairly. The 2024 GS Pay Scale for Administrative Assistants is expected to be released in December 2023.

Purpose of the GS Pay Scale

The GS Pay Scale serves several important purposes:

- Ensures that federal employees are compensated fairly for their work.

- Promotes consistency and equity in pay across different agencies and job titles.

- Helps to attract and retain qualified employees.

Determining Salary Range

The salary range for Administrative Assistants under the GS Pay Scale is determined by several factors, including locality pay, step increases, and performance-based pay.

Locality Pay

Locality pay is a geographic adjustment to the base salary that compensates for the varying costs of living in different areas. The United States is divided into 53 pay localities, and each locality has its own set of locality pay rates.

Step Increases

Step increases are annual increases in salary that are based on an employee’s length of service and performance. Employees typically receive a step increase each year until they reach the top step of their pay grade.

Performance-Based Pay

Performance-based pay is a type of pay that is based on an employee’s performance. Employees who consistently exceed expectations may receive performance-based pay in the form of bonuses, merit increases, or other forms of compensation.

Geographic Differentials

Geographic differentials are adjustments to the base salary of federal employees to account for the varying costs of living in different geographic areas. These differentials are determined by comparing the cost of living in a specific location to the cost of living in the Washington, D.C.

metropolitan area, which serves as the base for federal pay scales.

For Administrative Assistants under the GS Pay Scale, geographic differentials range from 0% to 25%, depending on the location of the job.

Geographic Differential Table

| Region | Differential |

|---|---|

| Continental United States (except Alaska and Hawaii) | 0% to 15% |

| Alaska | 20% to 25% |

| Hawaii | 15% to 20% |

| Puerto Rico | 10% |

| Guam | 15% |

| Virgin Islands | 10% |

The map below provides a visual representation of the regional variations in salary for Administrative Assistants under the GS Pay Scale.

[Insert map or infographic here]

Career Progression and Salary Advancement

Within the federal government, Administrative Assistants can progress their careers through promotions and by taking on additional responsibilities. Promotions typically lead to higher salaries and more challenging work. Administrative Assistants can also advance their careers by completing training and development programs, which can help them to develop new skills and knowledge.

Promotions

Administrative Assistants can be promoted to higher-level positions, such as Executive Assistant or Office Manager. These positions typically require more experience and responsibility, and they come with higher salaries. To be eligible for a promotion, Administrative Assistants must meet the minimum qualifications for the position and they must have a strong track record of performance.

Additional Responsibilities

Administrative Assistants can also increase their salaries by taking on additional responsibilities. This can include tasks such as managing projects, supervising other staff, or developing new policies and procedures. By taking on additional responsibilities, Administrative Assistants can demonstrate their value to their organization and make themselves more eligible for promotions.

Benefits and Allowances

Administrative Assistants under the GS Pay Scale are eligible for a comprehensive package of benefits and allowances. These benefits are designed to provide financial security, health coverage, and work-life balance.

Health Insurance

* Administrative Assistants have access to the Federal Employees Health Benefits (FEHB) program, which offers a wide range of health insurance plans to choose from.

These plans cover a variety of medical expenses, including doctor’s visits, hospital stays, and prescription drugs.

Retirement Plans

* Administrative Assistants are eligible to participate in the Federal Employees Retirement System (FERS), a defined benefit pension plan.

- FERS provides a guaranteed monthly retirement income based on years of service and salary.

- Administrative Assistants can also contribute to the Thrift Savings Plan (TSP), a 401(k)-style retirement savings plan.

Paid Time Off

* Administrative Assistants accrue paid time off (PTO) at a rate of 13 days per year.

- PTO can be used for vacation, sick leave, or personal business.

- Administrative Assistants are also eligible for 10 federal holidays per year.

Comparison to Private Sector Salaries

The GS Pay Scale for Administrative Assistants is generally comparable to salaries in the private sector, but there are some key differences to consider.

In general, Administrative Assistants in the private sector may earn higher salaries than their government counterparts, particularly in high-cost areas or in industries that pay a premium for administrative support. However, government employees enjoy a number of benefits and allowances that are not typically available in the private sector, such as health insurance, retirement benefits, and paid time off.

Experience

The level of experience an Administrative Assistant has can significantly impact their salary in both the public and private sectors. Administrative Assistants with more experience are typically paid more than those with less experience.

Location

The location of an Administrative Assistant’s job can also affect their salary. Administrative Assistants who work in high-cost areas, such as New York City or San Francisco, typically earn higher salaries than those who work in low-cost areas.

Industry

The industry in which an Administrative Assistant works can also affect their salary. Administrative Assistants who work in high-paying industries, such as finance or technology, typically earn higher salaries than those who work in low-paying industries, such as retail or hospitality.

Future Outlook

The future outlook for Administrative Assistants under the GS Pay Scale appears positive. The demand for skilled administrative professionals is expected to remain high in the coming years due to the increasing complexity of business operations and the need for efficient administrative support.

Projected Salary Trends

According to projections from the Bureau of Labor Statistics, the median annual salary for Administrative Assistants is expected to grow by 9% between 2021 and 2031, faster than the average for all occupations. This growth is attributed to the increasing demand for administrative support in various industries, including healthcare, education, and government.

Potential Changes in Pay Structure or Benefits

While the GS Pay Scale provides a structured framework for determining salaries and benefits, there may be potential changes in the future. These changes could include adjustments to salary ranges based on market conditions or changes in the benefits package to enhance employee satisfaction and retention.

Final Conclusion

In conclusion, the GS Pay Scale 2024 provides a structured framework for determining salaries and career progression for Administrative Assistants within the federal government. Understanding the factors that influence salary, such as locality, performance, and career advancement, is crucial for maximizing earning potential.

By leveraging the information and insights provided in this guide, Administrative Assistants can navigate the GS Pay Scale with confidence and make informed decisions that will shape their careers and financial well-being.