Breaking Down GS Pay Tables: What Each Grade Means – the federal government’s General Schedule (GS) pay system is a complex web of grades, steps, and factors that determine an employee’s salary. Navigating this system can be daunting, but understanding the basics is crucial for anyone working or seeking a career within the federal government.

This guide provides a comprehensive overview of the GS pay system, breaking down the structure of grades, steps, and the factors that influence your pay.

The GS system, managed by the Office of Personnel Management (OPM), is designed to ensure fair and equitable compensation for federal employees based on their job responsibilities, experience, and location. This system utilizes a series of grades, ranging from GS-1 to GS-15, to categorize positions and determine pay levels.

Each grade corresponds to a specific level of responsibility and required qualifications, with higher grades reflecting more complex and demanding roles.

Introduction to GS Pay Tables

The General Schedule (GS) pay system is the primary pay structure for federal employees in the United States. It sets standardized pay rates for over two million federal civilian employees across various agencies and departments. The GS system ensures fair and equitable compensation based on an employee’s grade, step, and locality.The GS pay system has a long history, dating back to the early 20th century.

It was designed to establish a standardized pay system for federal employees, replacing a patchwork of different pay structures that existed previously. The GS system aimed to create a more efficient and transparent system for determining employee compensation, promoting fairness and consistency across the federal government.

The Office of Personnel Management (OPM) and GS Pay Tables

The Office of Personnel Management (OPM) is the federal agency responsible for managing the GS pay system. OPM establishes the GS pay tables, which Artikel the pay rates for each grade and step. These tables are updated annually to reflect changes in the cost of living and other economic factors.OPM plays a crucial role in ensuring the integrity and fairness of the GS pay system.

It conducts regular reviews of the pay tables to ensure they remain competitive and attract and retain qualified federal employees. OPM also provides guidance and resources to federal agencies on implementing the GS pay system.

GS Pay Scales, Breaking Down GS Pay Tables: What Each Grade Means

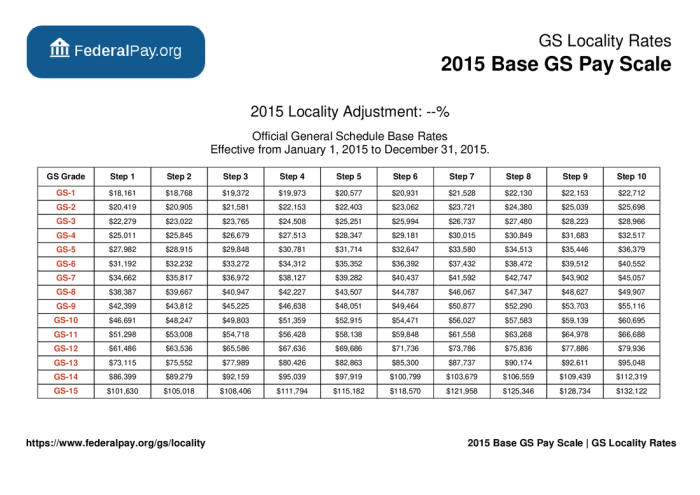

The GS pay system consists of 15 grades, ranging from GS-1 to GS-15. Each grade represents a different level of responsibility and expertise. Within each grade, there are 10 steps, which reflect an employee’s experience and performance.

Locality Pay

The GS pay system also includes locality pay, which adjusts base pay rates to reflect differences in the cost of living across different geographic areas. Locality pay is designed to ensure that federal employees are compensated fairly, regardless of their location.

Understanding the GS Pay Tables and what each grade represents is crucial for navigating the federal government’s salary structure. For IT professionals seeking a career in the public sector, Navigating the GS Pay Scale 2024: A Comprehensive Guide for IT Professionals provides a detailed breakdown of the pay scale and how it applies to different IT roles.

This guide can help you determine your potential salary range based on your experience and qualifications, enabling you to effectively negotiate your compensation package.

Step Increases

Employees receive step increases based on their performance and experience. These increases are typically granted annually, subject to agency performance standards. Step increases provide employees with a gradual increase in pay as they gain experience and demonstrate their skills and knowledge.

Breaking Down GS Pay Steps

Within each GS grade, there are ten pay steps that represent different levels of experience and expertise. Each step corresponds to a specific salary, and employees progress through these steps over time, receiving a pay increase with each step.

Step Increases

Step increases are designed to reward employees for their continued service and performance. They are typically awarded annually, but the exact timing may vary depending on the specific agency and position.

- Years of Service:The primary factor determining step increases is the employee’s years of service. Most employees receive a step increase after completing a full year of service. However, there are exceptions, such as when an employee is hired at a higher step based on their prior experience.

- Performance:While years of service are the primary factor, an employee’s performance can also influence their step increase. Agencies may have performance standards that must be met to receive a step increase.

Step Increases vs. Promotions

Step increases and promotions are distinct concepts. While both result in a higher salary, they are based on different criteria.

- Step Increases:Step increases are automatic increases within the same GS grade, based on years of service and performance. They do not involve a change in grade or job responsibilities.

- Promotions:Promotions involve a change in grade, typically to a higher grade. Promotions are based on an employee’s qualifications, experience, and performance, and they often involve a change in job responsibilities and duties.

Factors Influencing GS Pay

Your GS pay isn’t just a random number; it’s influenced by several factors. Understanding these factors can help you understand why your pay is what it is and how it might change in the future.

Factors Affecting GS Pay

Several factors influence GS pay rates. These factors are interconnected and can affect your pay in different ways. Let’s explore them in detail.

| Factor | Description | Impact on Pay | Example |

|---|---|---|---|

| Locality Pay | A cost-of-living adjustment based on the location of the job. It accounts for differences in housing costs, transportation, and other expenses across the country. | Increases GS pay in high-cost areas to attract and retain qualified employees. | A GS-9 employee in New York City might earn significantly more than a GS-9 employee in a rural area due to the higher cost of living in New York City. |

| Performance Awards | Recognition for outstanding performance and contributions to the agency. They can be given as cash bonuses or other forms of recognition. | Increases GS pay based on performance, incentivizing employees to excel. | An employee who consistently exceeds expectations might receive a performance award that increases their GS pay for the year. |

| Education and Training | Higher levels of education and relevant training can lead to higher GS pay grades. | Positions requiring specialized knowledge or skills typically have higher pay grades, reflecting the value of education and training. | A GS-11 position requiring a master’s degree might have a higher starting salary than a GS-9 position requiring only a bachelor’s degree. |

| Years of Service | Employees with more years of service generally earn higher GS pay. | Increases GS pay over time, rewarding experience and loyalty. | A GS-12 employee with 10 years of service might earn more than a GS-12 employee with 5 years of service, even if they have the same performance ratings. |

| Geographic Location | The location of the job can impact GS pay due to differences in cost of living and labor market conditions. | Higher pay in areas with a high cost of living or a competitive job market. | A GS-13 position in a major city might have a higher starting salary than a GS-13 position in a smaller town, even if the job responsibilities are similar. |

Navigating GS Pay Tables

Understanding how to navigate GS pay tables is essential for determining your potential salary and making informed career decisions. This guide provides a step-by-step approach to locating your GS pay rate, along with tips for interpreting the information presented in these tables.

Understanding the GS pay scale can be overwhelming, especially for administrative assistants navigating the different grades. Each grade signifies a specific level of experience, responsibility, and pay. To help you make sense of it all, check out Navigating the GS Pay Scale 2024: A Comprehensive Guide for Administrative Assistants.

This guide provides detailed information on the GS pay scale, specifically for administrative assistants, allowing you to understand your potential salary range and career progression. Armed with this knowledge, you can confidently navigate the GS pay tables and advocate for your deserved compensation.

Locating Your GS Pay Rate

GS pay tables are organized based on grade, step, and location. To find your GS pay rate, follow these steps:

- Identify your GS grade.Your grade is determined by your position’s level of responsibility and complexity. You can find your grade on your job offer letter, your official position description, or by searching for your position title on the Office of Personnel Management (OPM) website.

- Determine your GS step.Your step reflects your experience and performance within your grade. Newly hired employees typically start at step 1, with subsequent steps awarded based on performance and length of service. You can find your step on your job offer letter or by referring to your performance evaluations.

- Locate your geographic location.GS pay tables are adjusted based on the cost of living in different locations. The OPM website provides a list of standard metropolitan statistical areas (SMSAs) that are used to determine location-based pay adjustments. You can find your location on the OPM website or by searching for your specific city or county.

Understanding the intricacies of GS pay tables can be a bit daunting, especially when trying to decipher the meaning behind each grade. Luckily, there’s a comprehensive guide available that can help you navigate the system, specifically for human resources professionals.

Check out GS Pay Scale 2024 for Human Resources: A Comprehensive Guide to gain a better understanding of how salaries are determined based on your grade and experience. This resource can provide valuable insights into the GS pay system and its implications for your career path.

- Use the GS pay table to find your salary.Once you have identified your grade, step, and location, you can use the GS pay table to find your corresponding salary. The OPM website provides a comprehensive set of GS pay tables for different locations and years.

Interpreting GS Pay Tables

GS pay tables are presented in a tabular format, with columns representing grade levels and rows representing steps. Each cell in the table displays the corresponding salary for a particular grade and step. For example, a GS-9, step 5 employee in Washington, D.C., would earn a salary of $65,000 per year, according to the OPM GS pay tables for 2023.

Finding Resources and Tools

Several resources and tools are available to help you understand your GS pay:

- OPM Website:The OPM website is the primary source for GS pay tables, salary information, and other relevant information about the federal pay system. You can access a comprehensive set of GS pay tables, including historical tables, on the OPM website.

- Federal Pay Calculator:The OPM website also provides a federal pay calculator that can help you estimate your potential salary based on your grade, step, and location. This calculator is a valuable tool for understanding the potential salary range for your position and for comparing different pay options.

- Union Resources:If you are a member of a federal employee union, your union may provide additional resources and support regarding GS pay. Your union representative can answer questions about your pay, help you navigate the pay system, and advocate for your pay rights.

- Human Resources Department:Your agency’s human resources department can provide information about your specific pay and benefits. They can also answer questions about your pay grade, step, and location-based pay adjustments.

GS Pay and Career Advancement: Breaking Down GS Pay Tables: What Each Grade Means

The General Schedule (GS) pay system is not just about your current salary; it’s a roadmap for your career progression within the federal government. Understanding how GS pay scales work can help you plan your career trajectory and set realistic goals for advancement.

GS Pay Increases and Promotions

The GS pay system offers multiple avenues for increasing your salary and advancing your career. These include:* Promotions:Moving to a higher GS grade signifies increased responsibility, expertise, and contribution to the agency. This typically involves taking on new roles or responsibilities that require greater skills and knowledge.

Within-Grade Increases (WGIs)

These are annual pay increases that occur within your current GS grade and step. They are generally awarded based on satisfactory performance evaluations.

Performance-Based Pay

Federal agencies may offer performance-based pay increases for exceptional contributions. This can be in the form of bonuses, awards, or special pay adjustments.

Training and Development

Investing in your professional development through training courses, certifications, or advanced degrees can enhance your skills and qualifications, potentially leading to promotions or higher pay.

Career Paths and Pay Scales

The GS pay system offers a wide range of career paths, each with its own corresponding pay scale. Here are some examples:* Administrative Careers:Starting as a GS-5 Administrative Assistant and progressing through various positions like GS-7 Office Manager, GS-9 Administrative Specialist, and potentially to GS-12 Program Analyst or GS-13 Program Manager.

Technical Careers

Beginning as a GS-7 Engineering Technician and moving up to GS-9 Electronics Engineer, GS-11 Project Engineer, and potentially to GS-13 Senior Engineer or GS-14 Lead Engineer.

Law Enforcement Careers

Starting as a GS-5 Law Enforcement Officer and progressing through positions like GS-7 Special Agent, GS-9 Supervisory Special Agent, and potentially to GS-12 Inspector or GS-13 Chief Inspector.

It’s important to note that pay scales can vary based on location, agency, and specific job duties.

Last Word

The GS pay system is a fundamental aspect of federal employment, providing a framework for compensation and career advancement. By understanding the structure of grades, steps, and the various factors that influence pay, federal employees can navigate this system effectively and maximize their earning potential.

From understanding the basics of locality pay and step increases to exploring career paths and promotion opportunities, this guide serves as a valuable resource for anyone seeking to understand and optimize their GS pay.