Navigating the complexities of federal compensation can be a daunting task, especially for civilian employees. The General Schedule (GS) Pay Scale, implemented by the U.S. Office of Personnel Management, serves as the foundation for determining salaries for civilian federal workers.

In this comprehensive guide, we will delve into the intricacies of the GS Pay Scale 2024, exploring its structure, locality adjustments, step increases, special pay, and projected salary increases. We will also compare GS salaries to those in the private sector, providing valuable insights for career planning and financial decision-making.

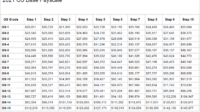

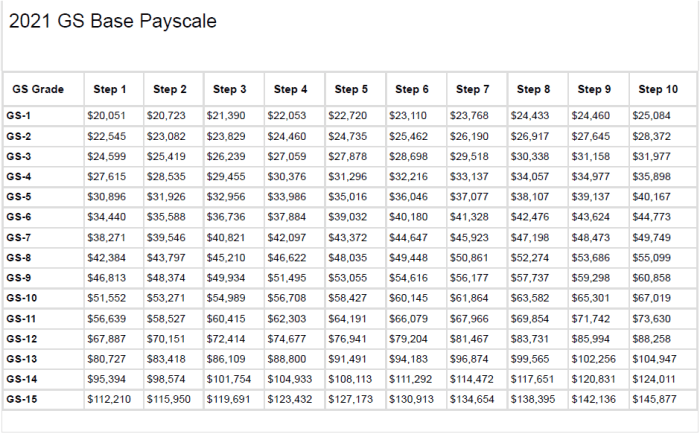

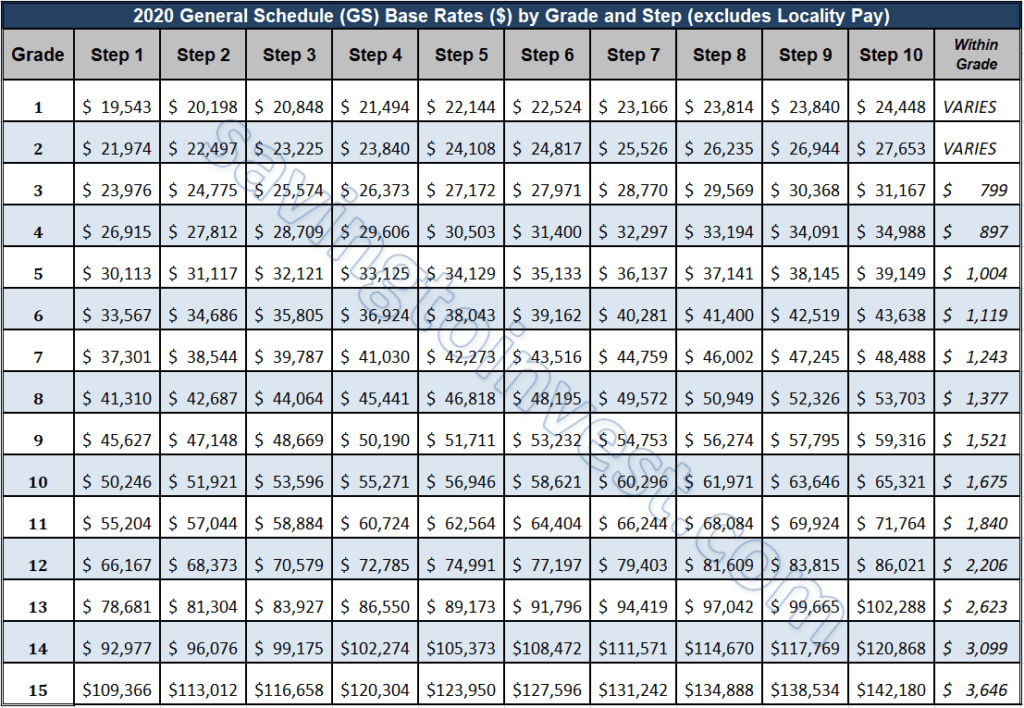

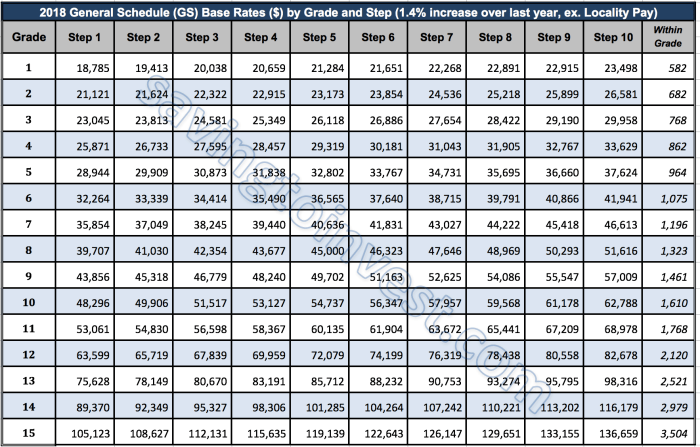

The GS Pay Scale is a structured system that categorizes federal civilian positions into 15 grades, each with 10 steps. The grade level reflects the level of responsibility and complexity of the position, while the step within the grade indicates the employee’s experience and performance.

Understanding the pay scale is essential for career advancement and ensuring fair compensation.

GS Pay Scale Structure

The General Schedule (GS) pay scale is a standardized pay system used by the federal government to determine the salaries of civilian employees.

The GS pay scale is divided into 15 grades, each of which is further divided into 10 steps. The grade of a position is based on the level of responsibility and complexity of the work performed, while the step within a grade is based on the employee’s length of service.

GS Grades and Salary Ranges

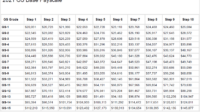

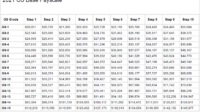

The following table Artikels the GS grades and corresponding salary ranges for 2024:

| Grade | Salary Range |

|---|---|

| GS-1 | $20,470

|

| GS-2 | $22,236

|

| GS-3 | $24,104

|

| GS-4 | $26,076

|

| GS-5 | $28,157

|

| GS-6 | $30,351

|

| GS-7 | $32,660

|

| GS-8 | $35,100

|

| GS-9 | $37,667

|

| GS-10 | $40,367

|

| GS-11 | $43,210

|

| GS-12 | $46,198

|

| GS-13 | $49,337

|

| GS-14 | $52,634

|

| GS-15 | $56,103

|

Locality Pay Adjustments

Locality pay adjustments are designed to account for the differences in the cost of living between different geographic areas. These adjustments are added to the base salary of GS employees and can vary significantly depending on the location.

The Office of Personnel Management (OPM) determines the locality pay adjustments for each geographic area based on a variety of factors, including housing costs, transportation costs, and other expenses.

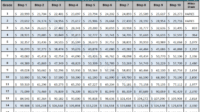

Locality Pay Adjustment Zones

The United States is divided into 50 locality pay adjustment zones. Each zone has its own unique locality pay adjustment percentage. The following table lists the locality pay adjustment percentages for each zone:

| Zone | Locality Pay Adjustment Percentage |

|---|---|

| Zone 1 | 0% |

| Zone 2 | 5% |

| Zone 3 | 10% |

| Zone 4 | 15% |

| Zone 5 | 20% |

The locality pay adjustment percentage is applied to the base salary of GS employees. For example, a GS-12 employee with a base salary of $60,000 would receive a locality pay adjustment of $3,000 (5%) if they worked in Zone 2.

Step Increases and Promotions

The GS pay scale provides for both step increases and promotions. Step increases are automatic salary adjustments that occur at regular intervals, while promotions involve moving to a higher pay grade.

Step increases are based on time in grade and performance. Employees typically receive a step increase every year, until they reach the top step of their grade. The step increase schedule is as follows:

Step Increase Schedule

| Step | Time in Grade |

|---|---|

| 1 | 0 years |

| 2 | 1 year |

| 3 | 2 years |

| 4 | 3 years |

| 5 | 4 years |

| 6 | 5 years |

| 7 | 6 years |

| 8 | 7 years |

| 9 | 8 years |

| 10 | 9 years |

Promotions, on the other hand, are based on merit and availability of higher-level positions. Employees must apply for promotions and compete with other candidates. The promotion process typically involves an interview and a review of the employee’s qualifications and experience.

Special Pay and Allowances

In addition to their base GS salaries, federal civilian employees may be eligible for special pay and allowances that supplement their earnings. These payments are designed to compensate for additional expenses or hazards associated with their job duties.

Special pay and allowances are typically provided in the form of:

- Premium pay: Additional compensation for working overtime, weekends, holidays, or night shifts.

- Hazard pay: Compensation for working in dangerous or hazardous conditions, such as in combat zones or with hazardous materials.

- Environmental differential pay: Compensation for working in extreme environmental conditions, such as extreme heat, cold, or altitude.

- Foreign post allowance: Compensation for living and working overseas, including housing, utilities, and other expenses.

- Overseas danger pay: Compensation for working in high-risk areas overseas, where there is a significant risk of personal injury or death.

Eligibility for special pay and allowances varies depending on the specific job and duty station. Employees should consult with their HR department or agency policy to determine which special payments they may be eligible for.

Projected Salary Increases

The General Schedule (GS) pay scale for civilian employees is expected to see modest increases in 2024, following a similar trend in recent years.

The Office of Personnel Management (OPM) has proposed a 2.6% average pay increase for GS employees, with adjustments varying slightly across different localities.

Locality Pay Adjustments

Locality pay adjustments are designed to compensate for differences in the cost of living in different geographic areas. In 2024, these adjustments are expected to range from 0% to 20%, with the highest adjustments occurring in areas with a higher cost of living.

The following table Artikels the estimated locality pay adjustments for 2024:

| Locality | Adjustment |

|---|---|

| San Francisco, CA | 20% |

| New York, NY | 15% |

| Chicago, IL | 10% |

| Dallas, TX | 5% |

| Phoenix, AZ | 0% |

Comparison to Private Sector Salaries

Government salaries are often compared to those in the private sector to assess their competitiveness. While direct comparisons can be challenging due to differences in job responsibilities and benefits packages, certain trends emerge.

Generally, GS salaries for entry-level and mid-level positions tend to be comparable to private sector counterparts. However, as employees advance in their careers, the salary gap between the public and private sectors may widen, with private sector executives earning significantly more than their government counterparts.

Factors Influencing the Gap

- Performance-based Pay: Private sector companies often offer bonuses and incentives tied to individual performance, while government salaries are typically based on a set pay scale.

- Industry Specialization: Salaries in certain industries, such as technology and finance, may be higher in the private sector due to specialized skills and market demand.

- Benefits Packages: While government employees typically receive comprehensive benefits packages including health insurance, retirement plans, and paid time off, private sector companies may offer more flexible or tailored benefits options.

Last Word

The GS Pay Scale 2024 provides a comprehensive framework for determining the salaries of civilian federal employees. By understanding the structure, locality adjustments, step increases, special pay, and projected salary increases, employees can make informed decisions about their careers and financial planning.

Additionally, comparing GS salaries to those in the private sector offers valuable insights into the competitiveness of federal compensation. As the federal government continues to play a vital role in the nation’s workforce, the GS Pay Scale will remain a critical tool for ensuring fair and equitable compensation for its civilian employees.