In the ever-evolving landscape of the tech industry, staying abreast of the latest compensation trends is crucial for IT professionals. The General Schedule (GS) pay scale, implemented by the U.S. government, serves as a comprehensive framework for determining salaries within various job classifications, including those in the IT sector.

As we approach 2024, it becomes imperative to delve into the intricacies of the GS pay scale and its implications for IT professionals.

This guide aims to provide a thorough overview of the GS pay scale, encompassing its structure, determining factors, and potential career progression paths. Additionally, we will explore geographic differentials, step increases, performance-based pay, and the array of benefits and allowances available to IT professionals under the GS system.

By equipping you with this knowledge, we empower you to make informed decisions regarding your career and compensation.

GS Pay Scale 2024 Overview

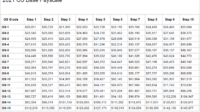

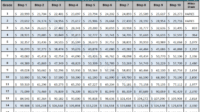

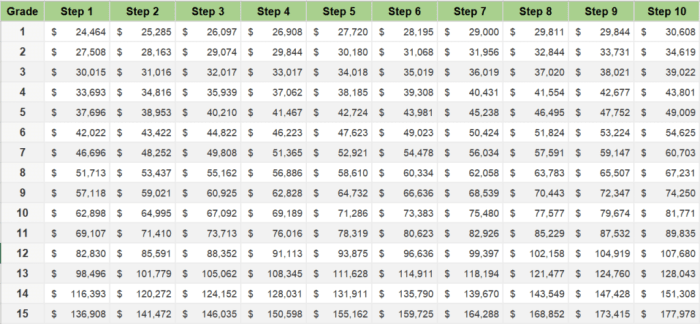

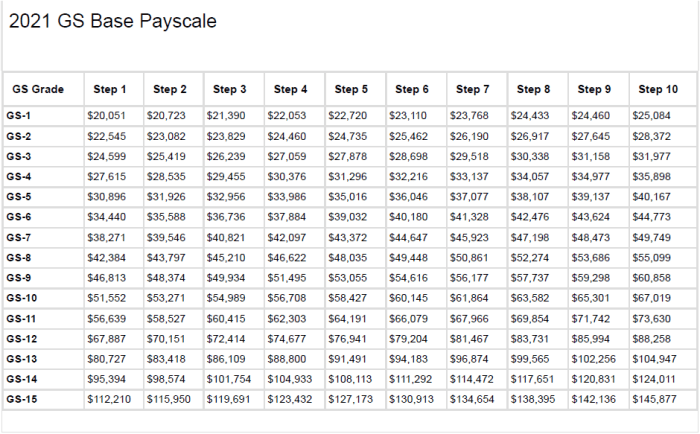

The General Schedule (GS) pay scale is a standardized system used to determine the salaries of federal employees in the United States. The GS pay scale is divided into 15 grades, each of which is further divided into 10 steps.

The grade of a position is based on the level of difficulty and responsibility of the work, while the step within a grade is based on the employee’s length of service and performance.The factors that determine pay grades and steps within the GS system include:

- The level of education and experience required for the position

- The complexity and difficulty of the work

- The level of responsibility and authority associated with the position

- The performance of the employee

The following table Artikels the GS pay scale for 2024, including base pay ranges for each grade and step:| Grade | Step | Base Pay Range ||—|—|—|| GS-1 | 1 | $20,395

$26,385 |

| GS-1 | 2 | $21,268

$27,604 |

| GS-1 | 3 | $22,170

$28,856 |

| GS-1 | 4 | $23,104

$30,143 |

| GS-1 | 5 | $24,069

$31,464 |

| GS-1 | 6 | $25,066

$32,819 |

| GS-1 | 7 | $26,100

$34,208 |

| GS-1 | 8 | $27,172

$35,633 |

| GS-1 | 9 | $28,279

$37,093 |

| GS-1 | 10 | $29,423

$38,589 |

Geographic Differentials and Locality Pay

Geographic differentials are adjustments made to the base salary of federal employees to account for differences in the cost of living between different locations. These differentials are determined by the Office of Personnel Management (OPM) and are based on factors such as housing costs, transportation costs, and other expenses.For

IT professionals, geographic differentials can have a significant impact on their salaries. For example, an IT professional working in San Francisco, California, will typically earn a higher salary than an IT professional working in a smaller city or town. This is because the cost of living in San Francisco is much higher than in other parts of the country.

Factors Determining Geographic Differentials

The factors that determine geographic differentials include:

- Housing costs

- Transportation costs

- Other expenses, such as food and utilities

OPM uses a variety of data sources to determine geographic differentials, including the Consumer Price Index (CPI) and the American Community Survey (ACS).

Geographic Differentials for Major Metropolitan Areas

The following table shows the geographic differentials for major metropolitan areas in the United States:| Metropolitan Area | Geographic Differential ||—|—|| San Francisco, CA | 25% || New York, NY | 20% || Los Angeles, CA | 15% || Chicago, IL | 10% || Dallas, TX | 5% |These differentials are applied to the base salary of federal employees in these areas.

For example, an IT professional working in San Francisco with a base salary of $100,000 would earn a total salary of $125,000, including the geographic differential.

Step Increases and Performance-Based Pay

Within the GS pay scale, IT professionals can receive step increases based on their performance and time in service. Step increases are automatic pay adjustments that occur at regular intervals and recognize an employee’s satisfactory performance.

To be eligible for a step increase, an IT professional must have a performance rating of at least “Fully Successful” and have completed the required amount of time in their current grade. The time required to progress through the steps varies depending on the employee’s grade and step level.

Performance-Based Pay

In addition to step increases, IT professionals within the GS system may also be eligible for performance-based pay. Performance-based pay is a type of compensation that is directly tied to an employee’s performance. There are several different types of performance-based pay available, including:

- Performance Awards: These are one-time payments that are given to employees who exceed expectations in their performance.

- Performance-Based Bonuses: These are bonuses that are paid out based on the employee’s performance over a specific period of time.

- Merit Pay: This is a type of pay that is given to employees who consistently exceed expectations in their performance.

The availability and eligibility for performance-based pay varies depending on the agency and the employee’s grade and position.

Benefits and Allowances

IT professionals under the GS pay scale are entitled to a comprehensive benefits package that includes various allowances and perks. These benefits are designed to provide financial security, health and well-being, and work-life balance for employees.

Eligibility for benefits and allowances may vary depending on factors such as employment status, length of service, and job level. It is important for IT professionals to familiarize themselves with the specific details and coverage of each benefit to maximize their utilization.

Health and Dental Insurance

The GS pay scale provides health and dental insurance coverage for employees and their eligible dependents. The plans offered include a variety of options, such as health maintenance organizations (HMOs), preferred provider organizations (PPOs), and high-deductible health plans (HDHPs). Employees can choose the plan that best meets their needs and budget.

Health insurance coverage includes medical, surgical, hospitalization, prescription drug, and preventive care benefits. Dental insurance covers preventive, basic, and major dental services.

Life Insurance

The GS pay scale offers life insurance coverage to employees. The amount of coverage is based on the employee’s salary and years of service. Employees can also purchase additional life insurance coverage if desired.

Retirement Savings Plan

IT professionals under the GS pay scale are eligible to participate in the Federal Employees Retirement System (FERS). FERS is a defined benefit pension plan that provides retirement income based on the employee’s salary, years of service, and contributions.

Employees can also contribute to a Thrift Savings Plan (TSP), which is a tax-advantaged retirement savings plan similar to a 401(k) plan.

Paid Time Off

IT professionals under the GS pay scale are entitled to paid time off, including annual leave, sick leave, and personal leave. Annual leave can be used for vacations, personal appointments, or other purposes. Sick leave is used for absences due to illness or injury.

Personal leave can be used for a variety of reasons, such as family emergencies or religious observances.

Flexible Work Arrangements

Many agencies under the GS pay scale offer flexible work arrangements, such as telework and flextime. Telework allows employees to work from home or another remote location. Flextime allows employees to adjust their work hours within certain parameters.

Other Benefits and Allowances

In addition to the benefits and allowances mentioned above, IT professionals under the GS pay scale may also be eligible for:

- Performance awards

- Training and development opportunities

- Employee assistance programs

- Wellness programs

Summary Table of Key Benefits and Allowances

| Benefit or Allowance | Description |

|---|---|

| Health Insurance | Medical, surgical, hospitalization, prescription drug, and preventive care coverage |

| Dental Insurance | Preventive, basic, and major dental services coverage |

| Life Insurance | Coverage based on salary and years of service |

| Retirement Savings Plan | FERS pension plan and TSP tax-advantaged savings plan |

| Paid Time Off | Annual leave, sick leave, and personal leave |

| Flexible Work Arrangements | Telework and flextime options |

| Other Benefits | Performance awards, training, employee assistance, and wellness programs |

Career Advancement and Salary Progression

Within the GS system, IT professionals enjoy ample opportunities for career advancement and salary progression. Career paths are clearly defined, providing a structured framework for employees to progress through the ranks.

Factors influencing salary progression include performance, experience, and education. Employees who consistently exceed expectations and demonstrate strong technical skills are likely to advance quickly and earn higher salaries.

Salary Trajectories

Salary trajectories for IT professionals in the GS system vary depending on factors such as job title, location, and experience. However, as a general rule, IT professionals can expect to earn salaries commensurate with their experience and contributions.

- Entry-level IT Specialist: $50,000-$65,000

- Mid-level IT Manager: $75,000-$100,000

- Senior-level IT Director: $120,000-$150,000

Last Recap

The GS pay scale for 2024 offers a structured and transparent framework for IT professionals to navigate their career progression and compensation expectations. By understanding the factors that influence pay grades, geographic differentials, and performance-based incentives, individuals can position themselves for success within the federal government.

The comprehensive benefits and allowances available under the GS system further enhance the overall compensation package, making it an attractive option for those seeking stability, growth, and a meaningful career in the IT field.